Home » ICM Asset Management partners go separate directions as rumors swirl

ICM Asset Management partners go separate directions as rumors swirl

Ex-employees have formed new financial advisory firm

March 30, 2017

A split between two former partners at a longtime, Spokane-based investment firm has led to the creation of a new firm here, with the previous company continuing to maintain $145 million in client investments under management.

Jim Simmons, CEO of 35-year-old ICM Asset Management Inc., says he’s recently been reassuring customers he will continue managing their assets while he begins the process of transitioning out of the role of chief executive officer.

“No, we’re not closing, but ICM is exploring potential partnerships with other investment firms with the desire to grow the firm,” Simmons says.

But in a March 22 letter, Simmons’ former ICM partner Pete Chase and two associates—both of whom left ICM to start Manito Asset Management Inc.— say they established the firm to prepare for the transfer of assets currently under ICM’s care.

“Manito was formed to facilitate an orderly transition from ICM as CEO, Jim Simmons, was to retire upon the sale of assets from ICM to Manito,” says the letter obtained by the Journal. The letter was signed by Chase, Manito Asset’s CEO; William Lang, chief investment officer; and Tim Olsen, the new firm’s head financial trader.

The letter continues, “Manito has diligently prepared for this transaction, completing regulatory filings, and establishing systems, processes, and office space. As of Feb. 1, 2017, we also transitioned the entire ICM operations and investment staff to serve as full-time Manito employees.”

“For client accounts at ICM, we have been contracted to execute and settle trades, and reconcile accounts through a services agreement that ends on March 31, 2017. We believe that it is our fiduciary responsibility to inform you that our team will not be in place to trade and grow your accounts after March 31, 2017, if your account remains at ICM,” the letter reads.

“I think we’re going to be a great addition to the local economy,” says Chase, reached this week by the Journal while in France.

While Simmons declines to elaborate specifically about the Manito Asset letter, he says he decided to continue managing the firm he founded after several clients told him they didn’t feel comfortable moving their money to Manito.

“There were enough clients that were uncertain about going to the new firm that didn’t feel comfortable without me being involved in it,” Simmons says.

Fueling investor confusion was an online post by the Investor Defense Law Blog that, as of March 28, said ICM planned to close its doors permanently in April. The blog post didn’t identify sources for the story, but it did speculate that ICM had been “unable to balance its budget for years.”

Simmons says there were several inaccuracies in the blog post, specifically related to the issue of being unable to balance its budget.

He says the U.S. Securities and Exchange Commission conducted a routine audit of ICM last November, which he says was the firm’s first audit in 13 years.

“They told me they hadn’t been back for so long in part because of the fact that in 2003 their audit of us was near perfect. This last audit revealed some things that they wanted to know more about, and I told them,” he says.

Simmons says ICM grew fast in the late 1990s and early 2000s. Back then, the company managed 10 times as many financial accounts as it does now. He says the 2,000 accounts it managed then was an all-time high, and ICM’s staff included almost 50 employees.

One of its clients, Simmons says, was a large public benefit plan based in Los Angeles. Simmons wouldn’t identify the entity, but said when the managers of the public plan moved money out of ICM to another financial company, it put ICM in a financial bind.

To meet all the firm’s operating expenses, Simmons says he borrowed money from some clients, with their permission, though he declines to say how much he borrowed.

“These are clients that were paid back, in full, many years ago,” he says. “I told the auditors the events of that time, they subsequently confirmed with those clients that ICM paid them back in full, and told me, ‘Don’t ever do that again,’’’ Simmons says.

He says, “When I look back at that time, I realized that was my fault because I’m loyal to a fault. The last thing I wanted to do was just bounce my employees on the street.”

The split between Simmons and Chase occurred less than two years after Simmons brought on Chase as an ICM partner.

In June 2015, Simmons told the Journal he had named Chase as a partner to help recapture investors who had done business with ICM before the Great Recession.

Now, Chase and a half-dozen former ICM employees are with Manito Asset Management, which is located on the third floor of the Legion Building downtown at 108 N. Washington.

“I wish them the best,” Simmons says of their departures. “This gives clients a new investment opportunity in Spokane.”

Chase says Simmons had been indicating to staff and investors around November of last year that he’d be retiring in early 2017, and he and ICM staff began preparing to establish the new investment firm.

“In about November, December of last year, Jim began communicating his intentions to retire,” Chase says. “As an entrepreneur myself, I saw a great opportunity and need for a new investment firm in our community.”

Chase was one of the original founders of Purcell Systems Inc., a Spokane Valley-based company that makes temperature-controlled outdoor cabinets for the telecommunications industry. He, along with Spokane entrepreneurs William Miller and George Thompson, launched Purcell Systems in 2000 in Liberty Lake.

A private equity firm bought out Miller’s and Thompson’s interests in 2005. EnerySys, a global industrial battery manufacturer, bought Purcell for $115 million in 2013. Chase had left the company by then, but had remained a shareholder.

Simmons was one of Purcell Systems’ first angel investors, Chase previously told the Journal.

Chase says Lang and Olsen continue to do the work they did when they were employed at ICM.

“They’re doing deep research for the purpose of actively managing our clients’ portfolios,” Chase says. “We wanted to make sure the investors were protected. It was understood that ICM would be closing. I’m not quite sure what Jim is doing, but I wish him well.”

Chase declines to say how many former ICM clients, total clients, and how much in assets under management Manito Asset Management has secured.

As for ICM, Simmons now has turned to partnering with Boise-based Harmonic Investment Advisors Inc., founded and operated by Kevin Jones, a chartered financial analyst who worked for Simmons at ICM from 1993 to 2002 before moving to Boise.

Simmons and Jones say a partnership between the two firms will involve their overseeing the previously mentioned $145 million in assets under management.

“Down the road, it may be possible that ICM will change its name to something else to reflect future partnerships. I’m 68. It (ICM) will have to evolve into partnerships with some other entity,” Simmons says.

ICM has between 80 and 90 clients, which include corporations, small businesses, nonprofits, pensions, families, and individuals, he says.

“There’s a client I’ve had for 30 years, who every year for the last 10 has asked me, ‘What am I going to do with my money when you get hit by a bus?’’’ Simmons says.

“And that’s what we’re working on. I want to take care of the clients I’ve had and give them a safe, migratory investment path for their futures while I go to spend more time fishing and riding my motorcycle,” he says.

Jones, who for now plans to remain based in Boise, says, “The goal is to build the asset base with clients and institutional business.”

Pending approval from the SEC, Harmonic will manage ICM’s small-cap portfolio, which Jones says is his specific area of expertise.

Before forming Harmonic, Jones, 52, was CEO of Boise-based D.B. Fitzpatrick & Co. and oversaw all investment-related functions of the $850 million of assets under management there while overseeing the firm’s daily operations, he says.

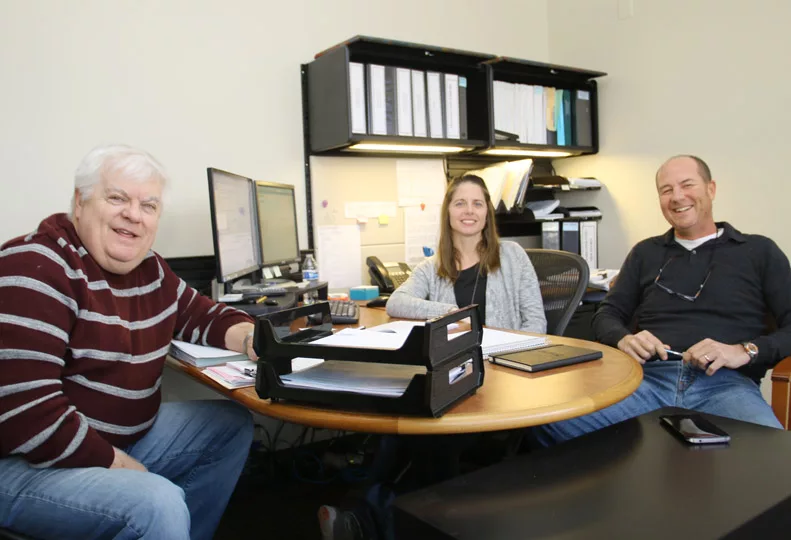

ICM now has three employees, Simmons; Lisa House, the chief compliance officer and head of operations; and an administrative assistant, Simmons says. The three occupy 11,000-square feet of cavernous space on the ninth floor of the Chase Financial Center, at 601 W. Main.

“Obviously, we don’t need nearly all this space and have been having discussions with the landlord about alternative plans,” Simmons says.

Latest News Banking & Finance

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)