_web.webp?t=1768464069)

Home » Power company here sees project pipeline soar

Power company here sees project pipeline soar

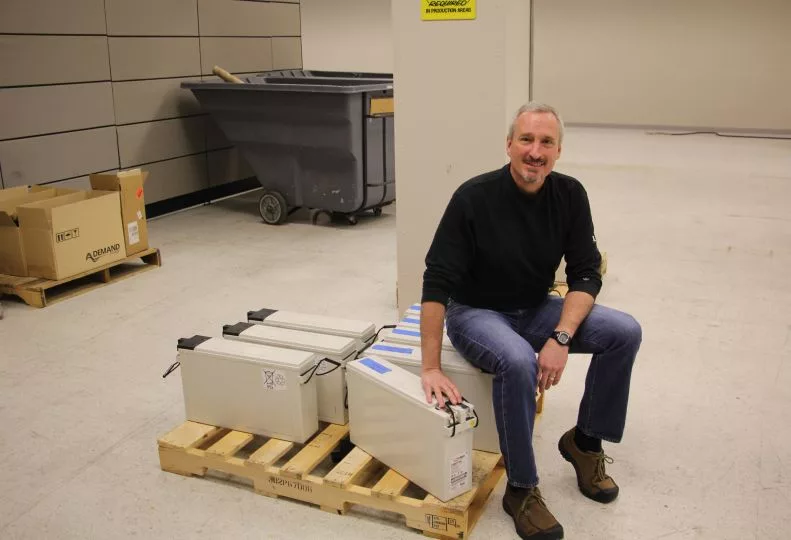

Demand Energy anticipates ramping up its workforce

April 7, 2016

Demand Energy Networks Inc., the Liberty Lake-based energy-storage company, is expanding into new markets, both in the U.S. and abroad, and currently has $130 million worth of potential projects in its pipeline, says company President and CEO Gregg Patterson.

He claims the company continues to be the first and only company certified to install energy-storage systems in New York, and says it also has secured contracts in California, Hawaii, and Costa Rica.

Patterson says about $52 million worth of projects, or 40 percent of the total estimated pipeline of potential work, already has reached the engineering and negotiation stages, meaning those projects likely will see completion.

“In the engineering and negotiation phase, we evaluate the site and create a project proposal, which is followed by a letter of intent, followed by a commercial agreement with the client,” he says. “All of these stages include complex analysis of buildings, locations, and rate structures, and usually involve us having to engage with the area utility as well.”

Patterson says he expects about one-third of the company’s projects to reach completion within the next year or so.

“We’re always looking to expand and improve our products,” says Patterson. “We’ve seen a huge uptick in contracts in the last year, moving from $10 million of projects in the pipeline, to the $130 million we’re seeing now.”

Patterson says Demand Energy currently has 18 employees, but due to its growth in sales, it expects to bring its staff up to 40 within the year. The company occupies 6,000 square feet of space on the Meadowwood Technology Campus at 24001 E. Mission.

Demand Energy creates systems that store energy on batteries during periods of low usage, and then distribute it during peak usage times.

In areas where electricity is more expensive—New York City, California, and Hawaii—utilities will charge more for energy during peak times of the day, or for spikes in usage.

The Demand Energy system enables building owners to save money through reduced energy costs, and also helps utility companies by having customers access power in reserve rather than pulling from the grid during peak usage times.

Last year, the company broke into the New York City market, having been awarded a contract to deploy a one-megawatt distributed energy storage system for a company called Glenwood, which owns several luxury rental properties in Manhattan.

Patterson says it took longer than expected to meet regulation approvals, but the company began installing by the end of last summer and expects to complete the project in mid-summer this year.

He says he expects the energy-storage market in New York City to grow to $4 billion to $7 billion in the next 10 years.

“We have an advantage in New York as we’ve spent several years focusing on that market almost exclusively,” says Patterson. “There are more challenges in California markets, as they have more regulations, and it’s more difficult to get customer traction there.”

Nevertheless, Patterson says the company, has been seeking to expand its presence there, as well as in the aforementioned Hawaii and Costa Rica.

“The Costa Rica project was for a medical manufacturing company that needed a consistent power supply to what they call a clean room environment,” says Patterson. “Our system helps them save money, but also provides them with energy storage they can use to keep that environment powered during emergency outages, protecting a vital part of their manufacturing process.”

Patterson says the company has similar energy storage projects going on in the other states, enabling clients to store solar energy in batteries and save costs by being able to operate with less dependency on the local electric utilities.

Patterson declines to disclose the company’s revenues, but he says that while costs have remained similar to last year’s $350,000 to $500,000 to build and $150,000 to install a typical energy-storage system, the expense will soon start to decrease as the price of batteries continues to fall.

“With technology improvements, particularly electronic vehicles that use lithium batteries, there is an interest in investing in research and development that is driving costs down,” he says. “I would expect battery prices to reduce by half over the next 10 years.”

He says lithium batteries generally cost more to make, but have greater storage capacity and performance life.

“We’re all trying to refine and enhance the technology, and I expect that by the 2020s, energy storage will be a $100 billion market,” he says.

While each unit is different, Patterson says most Demand Energy systems can store 100 kilowatts of energy. A large single-family home generally needs 5 kilowatts, so one 100 kilowatt system represents enough energy for 20 homes.

“If you installed 10 systems, so 1,000 kilowatts (or one megawatt), then that represents enough power for 200 large single-family homes,” he says.

Patterson says the company continues to improve its control system, and to develop new types of lead acid and lithium batteries with longer life and better storage capabilities.

He says the company currently is purposing a new storage testing lab in the Tri-Cities area, a project on which it would be partnering with the U.S. Department of Energy and the Pacific Northwest National Laboratory.

“This will be a place where we can continue to evaluate our control systems, test market models, and research new battery types,” he says.

In the lab, Demand Energy and the Department of Energy will be working with companies such as Seattle-based EnerG2 to test the performance and life span of different batteries. EnerG2 manufactures carbon materials for energy-storage devices and is working with another company, C&D Technologies Inc., to create a new lead acid battery.

Patterson says Demand Energy continues to work several battery manufacturers, but mainly with EnerSys, the Reading, Pa.-based battery manufacturer that bought Spokane Valley-based Purcell Systems Inc. in 2013. Through the partnership, EnerSys handles the manufacturing and Demand Energy focuses on software and analytics.

“Batteries are getting better all the time,” says Patterson. “What we look at is how to continue to keep costs low and performance high. So we’re always keeping an eye on the technology, and developing partnerships in what we call transactive markets.”

Transactive refers to techniques used to manage power generation and consumption, which factor in economic dynamics and grid reliability constraints.

“Each region, utility company, and building could potentially have unique opportunities or constraints,” he says.

For example, he says “Demand Energy’s core business model is to save on the customers’ energy bills from the utility, but more and more utilities are allowing companies like us to use the storage systems we install in buildings to generate additional revenues beyond bill savings, by providing a variety of services to the grid. These are referred to as transactive markets.”

Utility companies pay Demand Energy directly for such services, which according to Patterson help with power quality, as well as the balancing of supply and demand.

“Basically, we have to figure out the best ways to add value and performance capability, while maximizing economic return for the customer and the utility,” says Patterson.

He says Demand Energy’s focus right now is on installing its systems in industrial and commercial properties, including multifamily residential complexes, as the market hasn’t yet begun looking into residential single-home usage of storage systems.

“Our company is at this wonderful point, having basically created the market in New York City, and now being able to grow with it,” asserts Patterson. “We’re poised for some incredible growth.”

Latest News

Related Articles

_web.webp?t=1768346788)

_web.webp?t=1768464171)