_web.webp?t=1768464069)

Home » Industrial vacancies rise here

Industrial vacancies rise here

Study puts overall rate at 8.5 percent, though that still is 'pretty good'

December 18, 2008

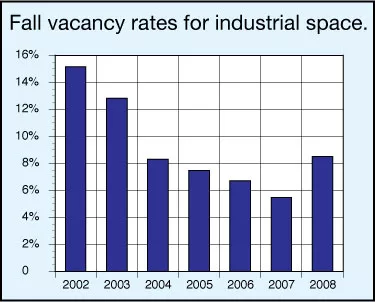

Vacancy rates for industrial space in the Spokane area have jumped sharply after five straight years of declines, a recent survey shows.

The fall vacancy survey conducted by the Spokane real estate appraisal firm Auble, Jolicoeur & Gentry put the overall vacancy rate for industrial space here at 8.5 percent, up from 5.7 percent a year earlier and the highest level since 2003, when it was 12.8 percent.

Industrial space in the survey includes warehouse, manufacturing, and related office space.

Normally, "anything below 10 percent is pretty good," says Scot Auble, president of the appraisal firm.

Yet, when the most recent survey is broken down into six geographic areas, two of them—East Spokane and the city of Spokane Valley—have edged above that 10 percent threshold, Auble says.

Vacancy-rate concerns aside, Greater Spokane Incorporated, a business advocacy group, has hired CB Richard Ellis Inc., a Los Angeles-based real estate management and consulting company with a Seattle office, to help identify priorities that would need to be addressed to help draw potential industrial users to the West Plains area.

Robin Toth, GSI's director of business development, says the West Plains area has a lot of raw land that would be suitable for industrial uses, but not much of it is ready to build on due to lack of infrastructure.

Potential industrial interests likely would be looking for access to water, electricity, natural gas, transportation systems, and an available, educated work force, among other desired amenities.

"The list is 30 to 50 items long," she says. "CB Richard Ellis brings us the expertise to identify what we would need right away if someone is looking for an industrial site."

Toth says business advocates here can't respond to certain requests for proposals because land isn't available or ready.

For instance, no Spokane-area representatives answered a request for proposals for a site that would accommodate a 1 million-square-foot distribution center for Minneapolis-based retail giant Target Corp. a few years ago because there was no land available here that could have been built on in a timely manner, she says.

"Typically, we're seeing that industrial users want to be in a building 18 months from the time they identify a site," she says.

Pete Thompson, a commercial and industrial real estate specialist with Spokane-based Hawkins Edwards Inc., says he believes there's several parcels of land available on the West Plains that would suit big industrial interests.

Thompson says, however, that it's prohibitively expensive to develop more industrial land before there's a specific demand for it.

Toth says she expects CB Richard Ellis to complete its report within six months.

"Once we receive a report with recommendations, we'll work with municipalities to develop a plan," she says, referring to Airway Heights, Medical Lake, and Cheney, in addition to Spokane County.

Along similar lines, the city of Spokane is seeking state funding to help build infrastructure in an undeveloped industrial portion of the Spokane International Airport Business Park, which it owns jointly with Spokane County.

Spokane Mayor Mary Verner has said the city hopes to attract industries there that can take advantage of electricity and steam generated at the waste-to-energy plant, which is adjacent to the business park's property.

Mark Lucas, a real estate agent with Kiemle & Hagood Co., of Spokane, says most of the vacancy rate increase he's seen in industrial space here has been in smaller spaces of 5,000 square feet or less.

"Some of the smaller guys who came out of their garages are going back to where they came from," says Lucas, who specializes in selling and leasing commercial and industrial properties.

He says many larger industrial tenants are waiting to see what happens with the economy before they decide whether to expand.

"Just like after 2001, when people start feeling better about the economy, they'll have pent-up demand, and things can turn around quickly," he says.

Lucas says he believes more industrial property is for sale now than in other recent years.

"The for-sale side was always very tight," he says. "Now we're starting to see a few more industrial properties come on the market."

Those spaces span a range of sizes, with one of the largest being the 175,000-square-foot former Pristina Pine building in Spokane Valley, he says.

The Auble, Jolicoeur & Gentry survey showed the west Spokane area west of Latah Creek and the Spokane River had the lowest vacancy rate of six geographical sectors in the fall survey at 3.9 percent, although that rate was up from 1.5 percent a year earlier.

Spokane Valley, which has by far the most industrial space of any of the six geographic sectors in the survey, also had the largest increase in its industrial vacancy rate, which nearly doubled to 10.3 percent, up from 5.4 percent a year earlier. Similarly, the industrial vacancy rate in the East Spokane area roughly between the downtown area and Spokane Valley jumped to 10.4 percent, up from 6.4 percent a year earlier.

The survey showed a sharp drop in Liberty Lake's industrial vacancy rate, which fell to 3.9 percent, down from 9.6 percent a year earlier.

Auble says there's much less industrial space in Liberty Lake than in the Valley, and the Liberty Lake vacancy rate was reduced when industrial owner-occupants filled two buildings there.

Also showing improvement in the survey were the downtown area, which showed an 8.3 percent vacancy rate, down from 10.9 percent a year earlier, and North Spokane, which had a 5.6 percent vacancy rate compared with 5.8 percent a year earlier.

Average rent for industrial space has barely budged in recent years, Auble says, adding that little new industrial space has been added to the market because the cost of new construction would require above-market rent.

"There is a huge resistance in the marketplace to significant changes," Auble says.

Latest News

Related Articles

_web.webp?t=1768346788)

_web.webp?t=1768464171)