Home » Homes sales rise; foreclosures plummet in Spokane

Homes sales rise; foreclosures plummet in Spokane

After increasing last year, defaults hit 10-year low

February 1, 2018

Spokane-area single-family home purchases are expected to surpass the record reached in 2005, three years before the start of the Great Recession, says Rob Higgins, executive vice president of the Spokane Association of Realtors.

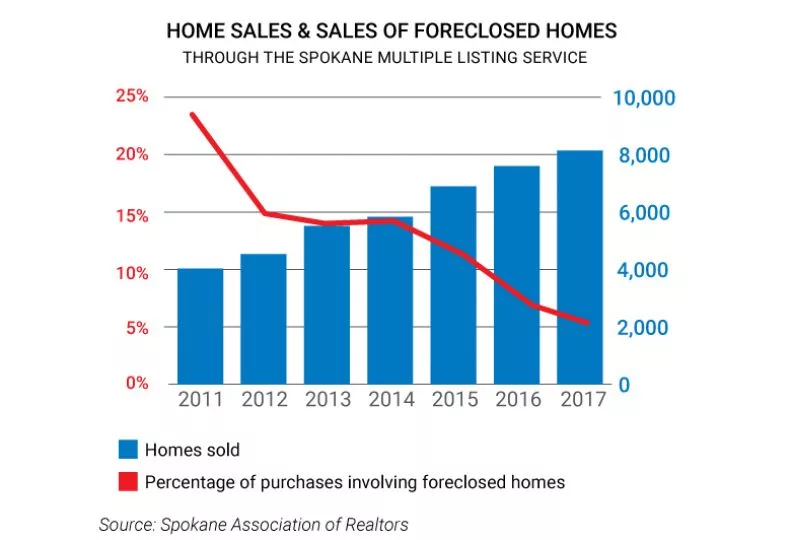

Last year, 8,137 single-family homes sales were reported through the Spokane Multiple Listing Service, up from 7,601 in 2016, Higgins says.

“Even projecting at a conservative rate of a 3-percent to 5-percent increase, Spokane County is still going to top its highest mark ever for home sales,” he says.

In 2005, Spokane County set the record for sales closed in a year with 8,373. Last year marked the second-highest number of home sales through the MLS in its recorded history.

Only 5 percent of total were in the category of “real estate owned sales”—foreclosed homes held by lenders and typically resold at discounted prices, Higgins says.

Figures provided by Higgins show that since 2011, single-family units sold in Spokane County have more than doubled while sales of foreclosed-upon homes have plummeted.

In 2011, of 4,025 homes sold, of that, 22 percent were purchased after a bank had foreclosed on them. The number of homes sold that year marked a 30-year low for Spokane County. But almost every year since then, home sales have increased while the percentage of homes residents have acquired from banks in foreclosure has decreased, says Higgins, citing statistics from the association’s Multiple Listing Service.

In 2012, 14 percent of 4,533 sold homes had been foreclosed upon. The following year, 5,510 homes sold with 13.2 percent bought following a default. In 2014, 5,829 homes sold with 13.4 percent among foreclosure. The next year, 10.7 percent of 6,892 homes sold were bank-owned properties. And in 2016, 6.6 percent of 7,601 homes sold were foreclosed properties.

Home sales here have been tracked for decades, but prior to 2011, the percentage of homes bought in foreclosure wasn’t recorded, Higgins says.

“There just wasn’t any need for tracking homes purchased in foreclosure because it was something that was so rare, at least until the recession came along,” Higgins says.

In all, the Spokane County Auditor’s Office recorded 464 foreclosures in Spokane County in 2017, down 68 percent from 2016’s mark of 778. There were 713 foreclosures in 2015, 982 in 2014, and 2013 marked a record year of 1,211 defaults.

The 464 foreclosure volume last year marks the lowest number of foreclosures in Spokane County since 2007, when there were 304 foreclosures.

That low was followed by 561 in 2008, 925 in 2009, 1,040 in 2010, 1,112 in 2011, 685 in 2012, according to information provided by the auditor’s office.

“Right now, we’re in pretty good shape,” says Grant Forsyth, the chief economist for Spokane-based Avista Corp.

Citing statistics from the real estate information website RealtyTrac, operated by Irvine, Calif.-based Renwood RealtyTrac LLC, Forsyth says both Spokane and Kootenai counties are faring slightly better than the rest of the U.S. in the context of foreclosure rates.

“It comes down to four key factors in the region,” Forsyth says. “Since the recession, we’ve experienced wage growth, rising employment, population growth from in-migration, and interest rates continue remain low.”

Both Higgins and Forsyth agree that the forces that led to a housing bubble and subsequent economic crash aren’t in place now as they were more than a decade ago.

“We just don’t have the new construction now that we did in ’03, ’04, and ’05,” Higgins says. “Builders still feel the hangover from the recession and don’t want an oversupply. There’s very little spec building in Spokane County going on.”

Also, says Higgins, people are staying in homes longer now than they were before the recession.

The average length of stay in a home previously was about seven years, from purchase to resale. That figure has now stretched to a full decade, he says.

Forsyth adds that banks today still operate under more strict loan regulations than they did before the Great Recession.

“I completely agree with Rob (Higgins),” Forsyth says. “There are several factors at work to mitigate some of the concerns about a potential bubble.”

Scott Wetzel, president and CEO of Windermere Services Mountain West, says he doesn’t foresee housing sales slowing anytime soon.

“It’s going to be continuous, slow, and measured growth. Things could slow for us because no inventory means no transactions,” he says.

Wetzel says he’s seeing more homeowners doing what he and his wife recently did by remodeling part of their home.

“We’ve been there 14 years and instead of selling and moving, we renovated,” he says. “Refinances and home equity lines of credit are on the rise because of this.”

Latest News Real Estate & Construction

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)