Home » Frugal janitor's life provides good financial lessons

Frugal janitor's life provides good financial lessons

Investors of modest means can become best clients

February 2, 2017

A number of years ago, I briefly worked for one of the largest brokerage firms in the country. While there, I received some of the best advice I ever received with regard to succeeding in the industry.

A number of years ago, I briefly worked for one of the largest brokerage firms in the country. While there, I received some of the best advice I ever received with regard to succeeding in the industry.

One of the top producers at that firm told me that if I wanted to succeed in the business, I needed to be strategic about who I prospected for business. He said I should avoid people with the newly constructed homes that appeared to be mini-castles. He stated that those who lived in brand new, beautiful homes with multiple new cars parked in four-car garages were, very often, not the best people to prospect.

Why? He felt that those types of people actually didn’t have money to invest, typically being so highly leveraged with debt that they were unable to invest. Instead, he reasoned that the best possible homes to prospect were those in less affluent parts of town, but that were modest and meticulously maintained. He said owners of those types of homes where it looked like “the front yards were vacuumed” were likely to be individuals who have lived below their means and, as a result, have substantial assets to invest.

Of course, I realize that there are many highly successful people who live in beautiful homes and have been responsible with their money. However, the advice I received always gave me a little caution when I interacted with presumably wealthy clients, and it always has encouraged me to pay attention to those who are truly wealthy, though you would never know it at first glance. Perhaps there are lessons that can be learned from the less obvious wealthy. That’s why I would like to share a few observations from the life of Ronald Read. He is a real-life example of the hypothetical prospect mentioned above.

Ronald Read was a lifelong resident of Brattleboro, Vt. He passed away in June of 2015 at the age of 92. A World War II veteran, Read spent his entire working life earning modest wages as a gas station attendant and a janitor.

To local residents, Read didn’t appear to be wealthy. In fact, one local resident attempted to pay his breakfast bill at a local coffee shop because he looked as if he might need help. Few people realized, however, until after his death, that he didn’t need help with the bill. In fact, Ronald Read, the local gas station attendant and janitor, left an estate valued at nearly $8 million, which he primarily bequeathed to the Brattleboro Memorial Hospital and the Brooks Memorial Library.

How is this possible? Ronald Read was an avid investor, and he was frugal. In fact, many media sources, including the Wall Street Journal, CNBC, the Washington Post, and others, have examined Read’s investing and life habits to explain his impressive wealth.

They learned that he was a careful stock picker. He was a daily reader of the Wall Street Journal and Barron’s, and spent much time studying his stock picks at the local library (note the gift left to the library).

Once he made his selections, Read would demonstrate great patience. At the time of his death, Read owned at least 95 different stocks invested across a variety of sectors, including railroads, utility companies, banks, health care, telecom, and consumer products. He had avoided technology stocks. He relied on blue chip stocks and avoided industries that he didn’t understand.

It was important to Read to select dividend-paying stocks. He received his dividend checks in the mail, and he then would buy more shares. Assuming a 3 percent dividend yield on the shares he owned, he was probably pulling down more than $20,000 a month in dividend income before taxes on top of the roughly $12-an-hour job he held. Among his longtime holdings were Procter & Gamble, J.P. Morgan Chase, General Electric, and Dow Chemical. At the time of his death, Read also had large stakes in J.M. Smucker, CVS Health, and Johnson & Johnson.

In addition to selecting dividend-paying stocks, one of the keys to Read’s success was that he was prepared to stick with his picks for long periods of time.

Read’s lifestyle helps to explain his investing success. He was extremely frugal. His most expensive possession was a 2007 Toyota Yaris valued at $5,000, which gave no hint of the size of his fortune.

He was very intentional about saving money in any way possible. For example, when visiting his attorney, he would park blocks away so he didn’t have to spend money on a parking meter.

His clothes were also very modest. He used a clothespin to keep his jacket together, which prompted a kind restaurant patron to offer to pay for his breakfast, as mentioned above. By all accounts, he seemed to enjoy his life and didn’t seem to need a lot of stuff to make him happy.

I’m not advocating that we all live like Ronald Read.

However, I must say that in my career, I seldom have worked with clients who have amassed an estate, primarily of stocks, valued at $8 million. Perhaps the extra $200,000 spent on a mortgage, the three extra car payments, and the boat payment might have something to do with cutting into a person’s net worth?

Maybe a little extra discipline in the area of personal finance and personal lifestyle can go a long way toward a higher net worth? Maybe each of us should consider living in a modest house that “looks like they vacuumed the front yard?”

If a retired gas station attendant and janitor can amass an $8 million estate, just think what is possible for us.

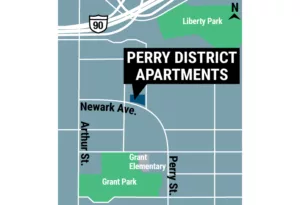

Rick Biel is a financial adviser with Biel Investment Management, in Spokane. He can be reached at 509-995-5734 or [email protected].

Latest News Banking & Finance

Related Articles