Home » Credit unions said bouncing back from losses in lending

Credit unions said bouncing back from losses in lending

Local execs say the 20 here all are doing well, despite a closure last year

January 27, 2011

Despite the mandated closure of The Union Credit Union here last fall, which was the first credit union failure in 15 years in Washington state, industry executives here and state regulators say the 20 credit unions continuing to operate in the Spokane area are doing well.

"Credit unions are looking very, very strong," says John Annaloro, CEO of the Washington Credit Union League, in Federal Way. "Especially when compared to the community banking environment, given that both institutions share a common economic region and a similar influence."

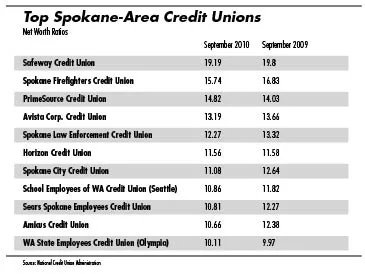

In credit unions, one measure of health is the net-worth ratio, which is determined by dividing the institution's net worth by total assets. The National Credit Union Administration says a credit union must have a net-worth ratio of at least 7 percent to be considered in good financial health.

On Sept. 30, 2010, the most recent date for which marketwide data is available, all 20 of the credit unions headquartered or operating in the Spokane area had net-worth ratios above that threshold percentage, according to data compiled by the Washington state Department of Financial Institutions (DFI).

Credit unions in the Spokane area had an average net-worth ratio of almost 11 percent, compared with a statewide average of about 9 percent. The highest net worth was 19.19 percent at Safeway Credit Union, and the lowest was 7.69 percent at Global Credit Union.

While healthy, the average net-worth ratio figures were slightly lower than they had been one year earlier. The Spokane-area average net-worth ratio on Sept. 30, 2009, was 11.4 percent, with the state average landing at 9.3 percent.

Those numbers fell slightly due to more borrowers becoming delinquent on their loans, says Linda Jekel, DFI's director of credit unions.

"Any time a loan is made, a member can usually make the payments over time, but during high unemployment, it's harder for them to find another job and continue loan payments," Jekel says. "So in a downturn, there are usually more delinquencies that are written off as losses."

In addition to Safeway Credit Union, others with high net-worth ratios as of the end of the 2010 third quarter were Spokane Firefighters Credit Union, at 15.74, and PrimeSource Credit Union, at 14.82, the data showed.

PrimeSource CEO Margaret Burkholz says that often, net-worth ratios depend heavily on a credit union's specific philosophy, and the number isn't the only marker of financial health consumers should consider.

"Different credit unions operate differently, and some feel that having high capital like that isn't indicative to giving back to members," Burkholz says. "Historically, we've always maintained a higher net capital in case of some kind of financial emergency."

Spokane-based Numerica Credit Union, which has 17 branches across Eastern Washington and North Idaho, had a net worth ratio of 8.79, as of September 2010, but was able to raise that number slightly to 8.86 in the fourth quarter, says CFO Cindy Leaver.

"A very good sign is the fact that our earnings are very strong, which shows that we ended the year well," Leaver says. "Despite the fact that we're having to pay more into the shared insurance fund maintained by the NCUA, we ended the year with a 1.12 percent return on assets. One percent is the benchmark that means we're doing well, so to end with that, we're pretty proud of that."

Leaver also says the ideal net-worth ratio can vary greatly from credit union to credit union, because some don't feel comfortable unless they stay over a certain percentage.

"Some aren't comfortable unless they're over 10 percent, but we've had the philosophy that we want that secure capital but also want to have fair pricing for our members," such as for lending rates, she says.

As the U.S. economy climbs out of the recession, a number of Washington credit unions have started to see their lending increase, despite the fact that consumer lending in general has fallen back, Annaloro says.

"In general, consumers are saving more and borrowing less," he says. "But, because some of the counterpart organizations on the banking side aren't lending as much, there has been a greater demand from the credit unions for that, so their loan volumes are up."

After the state-mandated closure of The Union Credit Union last fall, Numerica took over its deposits and memberships, and an Alaska-based credit union took over its assets and some of its loans, the DFI said.

Jekel says consumers in Washington shouldn't worry too much about other possible closures, unless their deposits are over the federally insured maximum of $250,000.

Annaloro says the situation in Spokane with The Union's closure was unusual.

"There are no more problematic institutions (now) than in any other year, and it's not unusual to see four to five credit union mergers per year," he says.

The most recent merger in the state, according to Jekel, took place last July, when All City Credit Union, of Everett, which had a net-worth ratio of less than 6 percent, merged with Northwest Plus Credit Union, also based in Everett.

She says no other planned mergers have been announced in the state, nor have there been any other closures since the Union closed last fall, when it had a net-worth ratio of -0.35.

"One of the important things about credit unions is that they went into the recovery period with pretty good capital, and they've been able to hang onto that and work with their members to try and keep their losses low," Jekel says. "I don't foresee any having to be closed in 2011. They all look good and have strong capital to weather this period."

Annaloro says there currently are about 124 credit unions operating in Washington state, and 110 of those are headquartered in the state.

It's estimated that about 40 percent of Washingtonians are credit union members.

Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)