Home » Miners hope the good times roll into 2011

Miners hope the good times roll into 2011

December 16, 2010

While many industries expect to plod through another year of a still-slogging economy, the mining industry expects a repeat of what has been a stellar 2010.

Metals prices continued to be strong this year, and in some cases jumped significantly, allowing Inland Northwest mining companies to improve cash flows and to have the confidence to pursue new development. No one seems to think that will change in 2011.

"The expectation is bullish," says Coeur d'Alene Mines Corp. spokesman Tony Ebersole.

Coeur has opened three mines in the last three years, and now is positioned to reap the rewards of higher production amid higher prices. It expects this year to produce 17 million troy ounces of silver and 170,000 troy ounces of gold, and that gold output would include just a half-year of production at its new Kensington Mine, in Alaska.

"We are in silver and gold and those are the two best performing metals in terms of the market," Ebersole says. "The outlook is for this to continue."

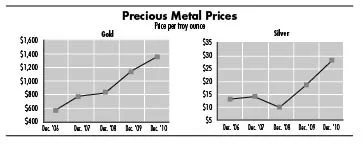

He says he hears predictions that silver will continue to sell for "north of $30" an ounce next year and that gold prices will remain "north of $1,400" an ounce. Both figures are far above the prices those metals were fetching two years ago, when gold was around $825 an ounce and silver was less than $10.

Strong metals prices were expected to boost the mood of attendees at the Northwest Mining Association's annual convention here last week.

"People are pretty fired up, all in all," says Laura Skaer, the association's executive director.

Still, Skaer says there are concerns among mining executives about federal regulators, who she contends are putting up roadblocks to job creation. "The mood in the industry is positive and upbeat about prices and those kinds of things, but there's frustration with the political climate."

Skaer believes that most metals prices should remain strong in 2011, based on demand from developing countries, and says she's encouraged by increasing interest by banks and investors in financing mining development projects.

Coeur d'Alene-based Hecla Mining Co. is expected in coming months to give the final go-ahead to a $150 million to $200 million project to develop a new, deep internal shaft at its Lucky Friday mine near Mullan, Idaho. The new shaft is expected to enable the mine to double its silver output. Hecla generated $115 million in cash flow during the first three quarters of this year.

For Spokane-based Gold Reserve Inc., the long road through an international arbitration process has begun. In September, the company filed a $1.9 billion claim against Venezuela with the World Bank in response to that country's seizure of its Brisas mining project there a year ago.

Coeur, which in addition to the Kensington has launched operations at the Palmarejo mine in Mexico and the San Bartolome mine in Bolivia in recent years, hopes to restart mining at the Rochester Mine in Nevada late next year.

—Paul Read

Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)