Home » Foreclosures accelerated here in 2009

Foreclosures accelerated here in 2009

Analysts believe return to 'healthy' default rate could take several years

January 28, 2010

Foreclosures in Spokane and Kootenai counties continued to climb in 2009, and economic analysts here say any turnaround will be gradual.

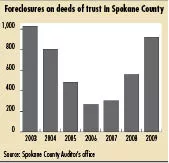

The Spokane County auditor reported 924 foreclosures on deeds of trust in 2009, up a steep 65 percent from 560 foreclosures in 2008 and more than 200 percent from 304 in 2007. The 2009 foreclosure total marks the third annual increase since foreclosures bottomed out at 269 in 2006.

The latest Real Estate Report, compiled by the Spokane-Kootenai Real Estate Research Committee and released semiannually, said notices of foreclosure had been filed on 1,961 deeds of trust in Kootenai County through September of last year and estimates the year-end total at 2,615, or 72 percent higher than the year-earlier total of 1,520 notices. Kootenai County's foreclosures are reported differently than Spokane County's, and not all notices reported in Kootenai County result in foreclosure. Nevertheless, the recently released report said, "Kootenai County clearly has a much deeper current problem than Spokane County."

Phil Kuharski, a longtime observer of the Spokane-area economy and a member of the research committee, says he believes foreclosures in Spokane County will level out before reaching the 2002 level of 1,152, which is the highest in more than 30 years.

"Foreclosures are the ultimate litmus test of the health of the real estate market," Kuharski says, adding, "A healthy market here could have 300 to 350 foreclosures."

Kuharski cautions, however, that he anticipates a slow economic recovery that won't be accompanied by significant job-market improvement until 2011 or 2012. Strong employment is one of the keys to stable foreclosure rates, he says.

Spokane County's unemployment rate climbed to 9.3 percent in December, up from 7.3 percent in December 2008, says Doug Tweedy, Spokane-based regional economist for the Washington state Department of Employment Security.

Spokane County had 227,650 jobs in December, and had a net loss of 6,000 jobs from December 2008, Tweedy says.

"I'm starting to see some slight improvement," he says. "Decreases in employment have flattened. In 2010, Spokane County probably still will have high unemployment, but it will trend lower."

The December unemployment rate in Kootenai County was 10.6 percent, up from 7.4 percent in the year-earlier month, according to the Idaho state Department of Labor.

Nationwide, the December 2009 unemployment rate was 10 percent, up from 7.4 percent in the year-earlier month, the U.S. Bureau of Labor Statistics reported.

Glenn Crellin, director of the Washington Center for Real Estate Research, at Washington State University, says foreclosures might not have peaked yet.

Nationally, a record 2.8 million properties were subject to some form of foreclosure action in 2009, up 21 percent from the year earlier, according to RealtyTrac Inc., an Irvine, Calif., company that compiles a database of foreclosure properties.

In Washington state, one in every 78 homes was subject to at least one foreclosure notice in 2009, RealtyTrac says in a report that ranks the state 24th overall in terms of foreclosure rates.

Crellin notes that Washington state was ranked among states with the lowest foreclosure rates before last year. "Now, Washington is in the middle of the stack and climbing," he says.

The median home sales price for homes sold in Spokane County in 2009 was $169,000, down almost 9 percent from $184,000 in 2008, according to the Spokane Association of Realtors' Multiple Listing Service.

Mortgage lenders in the county generally were more prudent than lenders in other parts of the country where subprime mortgages were prevalent, and partly because of that most homes here are worth more than is owed on them, Crellin says.

Less stringent lending practices likely played a role in Kootenai County, where the foreclosure rate is much higher than here, he says.

Prior to the recession, Crellin says, "Kootenai County had seen a rapid rise in housing sales and prices. A significant portion of buyers were transplants from California who were accustomed to different lending standards and transferred them here."

Single-family home sales in Kootenai County rose 6 percent in 2009 to 1,911 units, up from 1,802 sales in 2008, the Coeur d'Alene Association of Realtors Multiple Listing Service reported. The 2009 total marked the first increase in homes sold since 2005, when sales peaked at 3,808. The median home sales price, however, fell to $167,500 in 2009, a 12 percent drop from 2008.

Kuharski predicts that Spokane County will have fewer than 900 foreclosures this year, though the decline will be gradual.

"It will be higher than we want it to be," he says. "I'm optimistic it will improve over the next four or five years, but not a whole lot right away."

Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)