Home » Slow recovery forecast in most real estate sectors

Slow recovery forecast in most real estate sectors

December 23, 2009

The residential real estate market is expected to improve slowly here in 2010 following a four-year sales decline, while the commercial real estate sector might remain in the doldrums for a while yet, industry sources here say.

The number of home sales in Spokane County nearly doubled in November, climbing to 471, compared with 252 sold in the year-earlier month, says Rob Higgins, executive vice president of the Spokane Association of Realtors. Home sales also had improved in August and October compared with the year-earlier months, although the number of homes sold for the year through November was well off from the already lackluster figure for the year-earlier period, Higgins says.

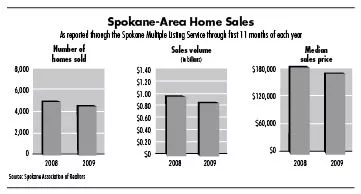

In the first 11 months of 2009, 4,308 homes were sold here through the Spokane Multiple Listing Service, down 6.9 percent from the year-earlier period.

Higgins says he expects 2009 sales will total more 4,500 units, compared with 4,910 last year, making 2009 likely the fourth consecutive year of declining home sales here.

Homes sales will approach 5,000 units in 2010 with a gradual increase in future years, Higgins predicts. "I would like to think that as far as unit sales go, we're close to the bottom if not past it," he says.

The market for commercial real estate, which also has declined, isn't showing signs that it will recover quickly, says Dave Black, CEO of the NAI Black commercial real estate brokerage here.

An annual fall survey of commercial properties conducted by the Spokane real estate appraisal firm Auble, Jolicoeur & Gentry shows that commercial vacancy rates in Spokane County rose in the office, retail, and industrial sectors compared with last year.

Black says he's seen especially steep declines in leases for retail space and sales of commercial-investment properties.

"I don't see it coming back, at least in the first half of 2010," he says. "I see it leveling out in mid- to late 2010."

Black cites two key reasons for a decline in real estate investment. "Financing is tough to get, and there's a gap between what sellers want and what buyers are willing to pay," he says.

Black says he doesn't expect much improvement in commercial investment "until banks start lending and sellers have more realistic price expectations."

In the residential market, the $8,000 first-time home-buyer tax credit has spurred activity, Higgins says. The credit has been extended through April, he says.

Legislation that extended the credit also expanded it to include a $6,500 credit for qualified repeat home buyers, which is intended to stimulate activity among "move-up" buyers, Higgins says.

He says he doesn't expect to see sales return anytime soon to their 2004-2006 levels, when average annual home sales topped 7,100 units.

This year through November, the median home sales price in Spokane County fell 8.4 percent to $169,000, from $184,500 in the year-earlier period.

Ken Lewis, broker at Prudential Spokane Real Estate, says he expects a "serious uptick" in home sales after the holidays, boosted largely by home-buyer tax credits and low mortgage interest rates.

"Sometimes you can find rates better than 4.5 percent" on 30-year mortgages, he says, although he expects rates to inch upward if the economy improves.

"Buyers are spoiled with new low interest rates," Lewis says.

After April, when the home-buyer credits are set to expire, the hope is that the economy will have improved enough that home sales will continue in an upward trajectory, Lewis says. "Our market usually does better in spring and summer," he says.

Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)