_web.webp?t=1768464069)

Home » 'Bank of banks' signals capital woes

'Bank of banks' signals capital woes

Spokane members expect Federal Home Loan Bank of Seattle will remain a strong partner

March 26, 2009

While the Federal Home Loan Bank of Seattle says it's disappointed with its own recently reported losses, and is experiencing a capital deficiency, some of its member banks and credit unions here say they're not alarmed and expect the federal "bank of banks" to remain a strong partner for the foreseeable future.

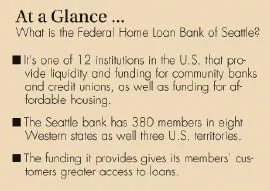

The Home Loan Bank, one of 12 such federally backed institutions across the country, provides liquidity and funding to about 380 member institutions, such as banks and credit unions, which are engaged in residential mortgage finance. It is a financial cooperative that also supports the availability of affordable homes and economic development in the communities it serves.

Its funding and financial services enable members to provide people with greater access to mortgages, commercial lending, and affordable housing. The bank commits 10 percent of its annual net income to help fund affordable housing and home ownership.

Its fourth-quarter and 2008 losses, along with its capital deficiencies, triggered some concerns in the press.

The Puget Sound Business Journal, quoting a Seattle-based banking analyst, reported recently that if capital problems continued for the Federal Home Loan Bank, it's possible it would squeeze lending to members or increase the cost of taking out a loan at a time when banks can't afford extra costs.

Yet, bankers here don't sound worried.

"We're not alarmed," says Daniel Byrne, chief financial officer and executive vice president at Spokane-based Sterling Financial Corp.

Byrne says the federal government has shown a pattern of standing behind a number of agencies like the Federal Home Loan Bank of Seattle.

"They're a strong partner," Byrne says. "We rely on them fairly heavily."

Sterling can borrow up to $3 billion from the Federal Home Loan Bank, and had $1.7 billion outstanding from it as of Dec. 31, Byrne says. That represents about 13 percent of Sterling's total funding.

Banks are required to invest in the Federal Home Loan Bank, and Sterling has invested about $90 million, which Byrne says the Spokane bank sees as "the price of access to the Home Loan Bank's funding services."

The Federal Home Loan Bank of Seattle reported a net loss of $199.4 million for 2008, compared with net income of $70.7 million for 2007, says spokeswoman Connie Waks. The 2008 loss was due primarily to impairment charges of $304.2 million for certain mortgage-backed securities. The bank currently estimates a principal loss of $12 million over the life of those securities, which is significantly less than the impairment charge, says Waks.

The Home Loan Bank is subject to three regulatory capital requirements: risk-based capital, capital-to-assets ratio, and leverage ratio.

"We remain in compliance with our capital-assets and leverage requirements, but with the decline in the prices of our mortgage-backed securities, we reported a risk-based capital deficiency" as of Feb. 28, Waks says. "Under Federal Housing Finance Agency regulation, a Federal Home Loan Bank that fails to meet any regulatory capital requirement may not declare a dividend or redeem or repurchase capital stock."

The ongoing turmoil in the capital and mortgage markets caused a decline in the market value of some of the Home Loan Bank's mortgage-backed securities, significantly beyond any expected actual loss, Waks says.

"We could find some relief on this issue if the mortgage markets were to stabilize," or if there were changes to the accounting rules, which are hurting businesses in the current economy, she says.

Randy Fewel, president and CEO of Spokane-based Inland Northwest Bank, says the Federal Home Loan Bank is an important source of liquidity to INB. Its recent troubles are "on our radar for sure, but I'm not overly worried about it."

Fewel adds, "We are watching it closely, and we are not happy that they won't be paying a cash dividend for awhile."

In a March 9 letter to its members, the Seattle institution says it regrets its inability to repurchase members' stock and return a dividend on investments in the cooperative.

Fewel says the capital deficiency is a concern, but he thinks its seriousness has been overstated.

"I'm not worried about their ability to continue to be an ongoing source of liquidity for us," Fewel says. "The loss was really a paper loss, and over time they'll be able to take that loss back, and we'll find out they're in much better shape than what the numbers now indicate. That's really because of the accounting issue. I think they'll be able to start earning a profit, and work their way out of this situation."

INB has invested $1.1 million in the Federal Home Loan Bank, currently has about $20 million loaned from the institution, and is eligible to borrow another $35 million.

Jack Gustavel, chairman and chief executive officer for Idaho Independent Bank, in Coeur d'Alene, which uses the Federal Home Loan Bank daily for liquidity purposes, says, "I'm not overly concerned. They are an agency of the U.S. government, and their operations are sound. They're feeling the effects of the financial problems we're all facing. I have some degree of confidence they are going to come through this just fine."

Gustavel adds, "I'd rather they were making money and doing better, of course, as we all would."

Greg Benneweis, vice president of finance for Global Credit Union, says, "We are not terribly reliant on them. But we've been a member for quite a few years. We have a traditional advance relationship with them."

Benneweis, who declines to say how much Global has invested in the Federal Home Loan Bank, says he's not concerned about the bank's stability.

"Like a lot of others, they face challenges in this environment," Benneweis says. "We feel confident that they can recover. We feel strongly that they'll be there in the future."

Greg Deckard, Spokane Valley-based State Bank Northwest's chairman, president, and CEO, says, "The operations of the Federal Home Loan Bank continue as designed, providing liquidity to its member banks."

Waks says all federally insured depository institutions and insurance companies engaged in residential housing finance and community financial institutions located in the district the bank serves are eligible to apply for membership in the Federal Home Loan Bank.

Its primary source of liquidity and funding comes from the sale of Federal Home Loan Bank debt to institutional investors. Its revenues primarily are derived from interest income from loans to members, investments, and mortgage loans held for its portfolio, says Waks.

Latest News

Related Articles

_web.webp?t=1768346788)

_web.webp?t=1768464171)