Home » Bankruptcy filings jump 29 percent

Bankruptcy filings jump 29 percent

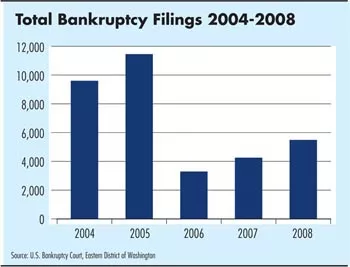

Totals, however, end up far below earlier high; recent trend worrisome

January 15, 2009

Filings in U.S. Bankruptcy Court in the Eastern District of Washington jumped 29 percent last year, but that increase was roughly the same as the year before and put Eastern Washington filings at a level well below what they were during the first half of this decade.

Perhaps more troubling, says a bankruptcy trustee here, is that filings rose more rapidly during the second half of last year than they did in the first half, and that surge appears to be continuing this year.

"I'm swamped," says the Chapter 7 trustee, Spokane attorney Bruce Boyden. "In the first seven days of the calendar year there were 50 filings already."

Boyden predicts that new filings could top 7,000 this year. Last year, 5,507 new cases were filed in the Eastern District of Washington, which includes cases for Spokane, Moses Lake, Yakima, Wenatchee, and the Tri-Cities. That's 1,300 more cases than the 4,270 cases filed in the district in 2007. The year earlier, filings had plummeted to 3,350, from a decade high of 11,506 in 2005, before an anticipated change in bankruptcy laws. More than 10,000 cases were filed in each of the years 2001, 2002, and 2003.

Avista Corp. economist Randy Barcus says last year's increase isn't as alarming as one would expect given the state of the economy in recent months.

"I would have expected activity in the second half of the year to be higher," given the chaos in the financial industry, Barcus says. "It doesn't seem to be a clear trend."

Meanwhile, bankruptcy filings in North Idaho soared last year. In the Coeur d'Alene court of the District of Idaho, total new case filings shot up 80 percent in 2008, to 744, compared with 414 the year earlier.

In U.S. Bankruptcy Court in the Eastern District, the largest increase in filings was for Chapter 7, which are liquidations. Such filings jumped 33 percent in 2008, to 4,271 from 3,210 the year before. Meanwhile, Chapter 13 cases, which involve partial or full repayment of consumers' debts over a three- to five-year period, rose 16 percent to 1,210. Chapter 11 filings, which typically involve the reorganization of a company or business, increased to 22, from 15 the year before.

One shift observed by Boyden is that a higher share of cases last year involved businesses. He says that in the past, about 80 percent of bankruptcy cases in which he has been involved were consumer cases, with the rest involving businesses.

"I'd say now we're about equal," Boyden says. "Of my last eight filings, five of those are business."

Boyden says if bankruptcy rules are changed to allow courts to modify the terms of home loans, Chapter 13 filings could jump dramatically. He says that currently, judges can alter many types of loans, but not home loans.

Barcus says a recent willingness of the government to become more involved in the workings of previously market-driven systems makes predicting what will happen in the coming year difficult.

"There are so many unprecedented things the government is doing right now it's hard to sort out," Barcus says. "At this point we just don't know, and I'm not alarmed by any of this information to the extent that I think it's the calm before the storm."

Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)