Home » Inland Northwest bankruptcy filings trend downward—for now

Inland Northwest bankruptcy filings trend downward—for now

Lawyers here expect filings to rise after end of pandemic-era consumer protections

February 2, 2023

Bankruptcy filings in 2022 continued the downward trend of the past several years in Eastern Washington, but bankruptcy attorneys here say filings are likely to climb this year.

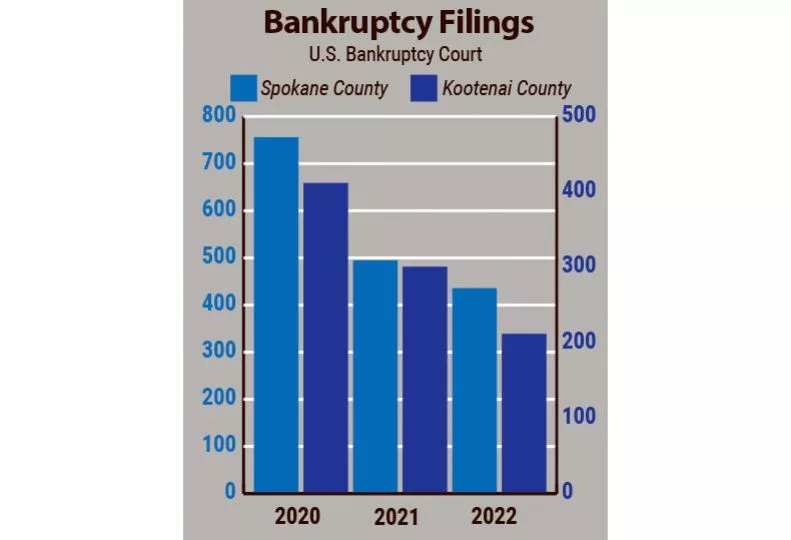

In 2022, 436 bankruptcy cases were filed in Spokane County, according to data from the U.S. Bankruptcy Court. That’s down almost 12% from the previous year—and a decrease of 42% from 2020.

Activity in Kootenai County declined more precipitously last year, with 212 bankruptcy cases filed in the North Idaho county. That’s down almost 30% from 2021 and nearly half of filing activity in 2020.

Data from Administrative Office of the U.S. Courts show bankruptcy filings throughout the U.S. have declined steadily since 2010.

According to Inland Northwest attorneys, however, bankruptcy filings are starting to show signs of increasing.

Rebecca Sheppard, attorney and owner of Spokane Valley-based Sheppard Law Office PC, says she’s noticed a slight increase in the number of inquiries her office fields from people about filing for bankruptcy.

“I’m seeing a higher volume of calls than I did last year at this time,” Sheppard says.

Many of those calls are from homeowners spurred to action by the threat of foreclosure.

“I have many clients in the pipeline who will be filing a bankruptcy in order to stop a foreclosure that’s scheduled to happen in the next 60 to 90 days,” Sheppard says.

Those clients typically seek Chapter 13 bankruptcy protection, which enables filers to make a plan to reorganize debt and gives them the opportunity to keep their property, Sheppard explains. Chapter 7, which involves a liquidation of assets, often involves selling property to pay off debts.

Jon Schwab, attorney and owner of Spokane-based Schwab Law PLLC, says the volume of phone calls he received last month regarding bankruptcy filings tripled compared to December.

Schwab says many programs that provided additional COVID-19-era financial benefits kept people from qualifying for bankruptcy.

“To qualify for Chapter 7, your expenses have to be greater than your income, and unemployment is included in your income,” Schwab says. “In households where at least one person was on unemployment, that usually bumped them out of the Chapter 7 category. The unemployment factor and benefits that have been available to the public over the last couple of years have resulted in incomes that are greater than expenses—at least on paper.”

The Federal Pandemic Unemployment Compensation program provided an additional $600 per week to individuals who were collecting unemployment beginning in January 2020.

That program expired in July 2020 and was replaced by a program that offered an additional $300 per week through March 14, 2021.

Some of those who had received additional unemployment funds did file bankruptcy after those funds ran out, Schwab says. Others have found ways to dodge bankruptcy by taking on additional jobs or additional debt.

Spokane-based bankruptcy attorney Lisa McBride, owner of law firm Elizabeth M. McBride PS, says more people have been relying on credit cards to bridge their financial gaps, but that’s unsustainable, especially as the Federal Reserve has raised interest rates and shows signs of approving additional rate increases this year.

“You don’t want to file bankruptcy on your credit cards (unless) you no longer can use them,” McBride says. “People are waiting for things to turn around, and we’re not seeing that happen with the economy.”

According to the Federal Reserve Bank of New York, consumers in America have a total credit card balance of $925 billion as of the third quarter of 2022.

That’s an increase of about 15% from the third quarter of 2021, but credit card debt in the U.S. was higher before the COVID-19 pandemic—total credit card debt in the U.S. hit a peak of $930 billion in late 2019.

In the second quarter of 2022, 233 million new credit accounts were opened—the most since 2008, the Federal Reserve Bank of New York says.

Meantime, interest rates on credit card debt have swelled to nearly 20%, an increase of about 4 percentage points over the previous year.

Sheppard says certain moratoriums that served to protect people during the pandemic also have expired.

“There were moratoriums on evictions and foreclosures and garnishments, which probably are the three main reasons people pull that trigger to file bankruptcy,” she says.

All three forms of legal processes were paused earlier in the pandemic, Shep–pard says, but have since been reinstated.

The Washington state moratorium on evictions ended June 30, 2021, while the state’s moratorium on residential foreclosures expired July 31, 2022. A similar state mandate disallowing garnishment of wages expired in January 2021.

McBride says the bankruptcy rate seems to be returning to the trajectory it was following prior to the COVID-19 pandemic.

“It dropped about 10% per year since 2008,” McBride says. “It was starting to pick up in 2019 and the early months of 2020, then COVID made it drop again.”

McBride says she expects to handle more bankruptcy filings in the latter months of 2023.

“We’re going to see a lot more people who want to file, because they’re running out of options,” she says.

Sheppard cautions against using data from the first quarter of the year to attempt to predict the volume of filings for the rest of the year. Tax season is typically quieter than the rest of the year in terms of bankruptcies filed, she says.

“Many people who have wanted to file but haven’t been able to scrape together the attorney’s fees to do so are suddenly able to as soon as they get their tax return filed and get that refund back,” Sheppard says.

She adds, “Something has to give. You still have so many people out there who are hurting and barely making it. It can’t continue forever.”

Latest News Special Report Banking & Finance North Idaho

Related Articles

Related Products

Related Events

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)