Markets without a map: When AI euphoria meets a data blackout

We're, in essence, experiencing information scarcity and what some perceive as speculative excess

According to the Efficient Market Hypothesis (EMH) pioneered by economist Eugene F. Fama, financial markets fully reflect all available information. In practice, that assumption is being tested today.

The prolonged U.S. government shutdown has disrupted the release of key economic data such as GDP, inflation, employment, and consumer spending, forcing investors and policymakers to make decisions with blurred economic data. Meanwhile, AI-related equities are soaring, fueling debate over whether markets are efficiently pricing innovation or inadvertently creating an asset bubble.

We are, in essence, experiencing information scarcity and what some perceive as speculative excess.

Since early October 2025, agencies such as the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) have delayed or stopped releasing data due to the shutdown. This information is central to investors and policymakers in assessing economic growth and performance. Without these data, the Federal Reserve and financial markets are effectively operating blindfolded, even though market efficiency depends on a transparent and reliable public information infrastructure.

The EMH assumes prices reflect all available information, but when official data disappears, market efficiency is eroded. As a result, the market becomes dependent on “noisier” signals, introducing greater uncertainty. In this context, risk premiums may widen, forecast models loose predictive power, and valuation precision diminishes. In a very real sense, a data blackout becomes an efficiency blind spot.

The S&P 500’s 2025 rally, driven largely by a handful of tech giants such as Nvidia, Microsoft, and Alphabet, has revived concerns of what former chair of the U.S. Federal Reserve Alan Greenspan termed “irrational exuberance.” According to this perspective, a surge in asset prices is based on overly optimistic investor behavior well above true asset values.

According to the EMH these price movements are rational because investors are incorporating expected future gains from AI adoption into current valuations. Asset pricing is based on the expectation that artificial intelligence will raise productivity, reduce costs, and expand margins across industries. However, many economists and analysts argue that current valuations have become detached from underlying fundamentals.

Robert Shiller’s concept of narrative economics suggests that markets sometimes trade on contagious stories rather than empirical data. This concept becomes relevant during a government shutdown, when information is asymmetric. Given that investors lack data, narrative economics becomes the evidence supporting the belief, for instance, that AI is transforming the real economy.

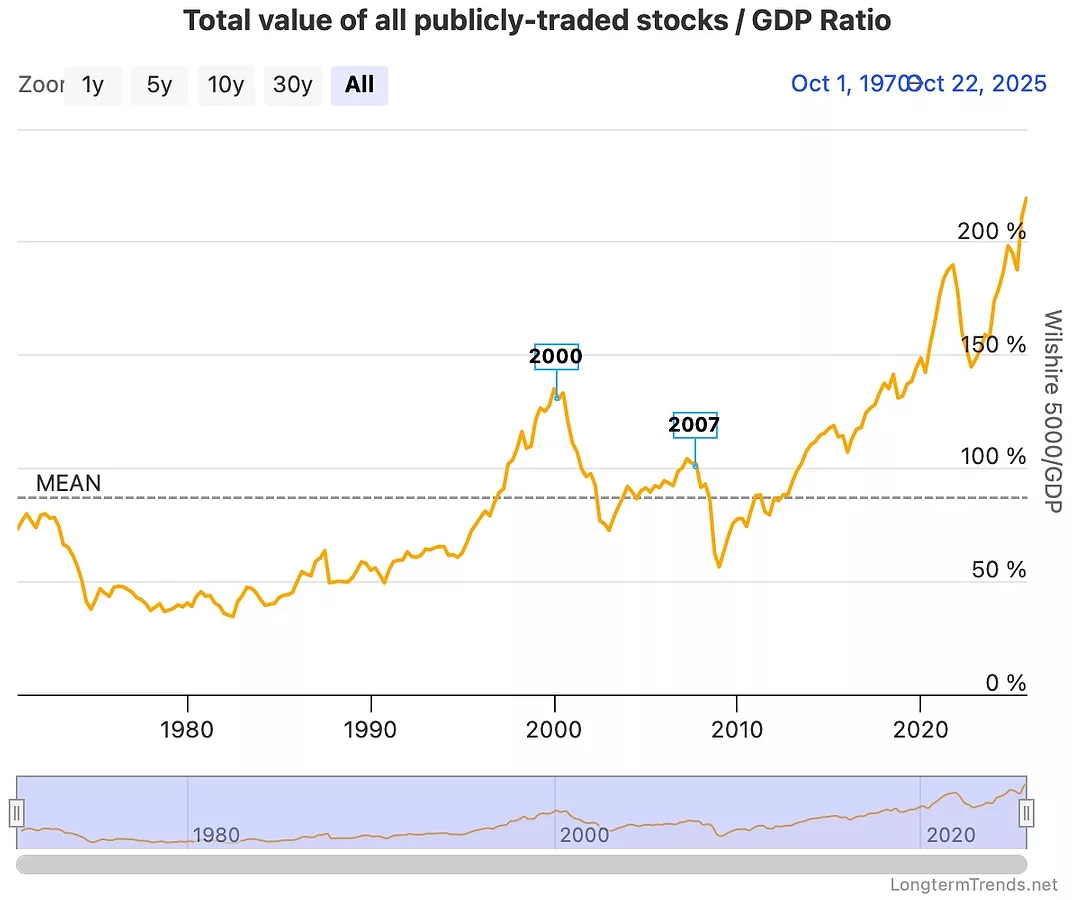

The ratio of total value of all U.S. publicly traded stocks to the nation’s Gross Domestic Product (GDP), or as some refer to as the Buffett Indicator, is a popular gauge of how expensive the stock market may be relative to the economy.

When the ratio runs high, it can signal that market prices are outpacing underlying economic growth. As of October 2025, the indicator hovers above 200%, according to Longterm Trends, well above its long-term average and close to levels seen during the dot-com boom. Many analysts see this as a sign that an AI-driven market surge may be pushing valuations beyond fundamentals, especially in an environment where delayed or blurred economic data make it harder to judge the market’s true footing.

In a recent CNBC article, AI optimists, including many top CEOs, held the view that artificial intelligence is a transformative breakthrough comparable to the internet revolution of the 1990s. They argued that today’s soaring market valuations simply reflect expectations of future productivity gains.

Economists such as Jared Bernstein, however, warned that familiar bubble dynamics may be emerging, given the handful of tech giants driving most market gains. Other indicative trends include an earnings disconnect relative to prices as leading AI firms trade at forward P/E ratios above 30, and investor herding as AI-focused ETFs attract record inflows.

The consequences of a government’s shutdown extend far beyond Wall Street. Businesses depend on official data for planning, hiring, and pricing. Economists use it to forecast economic activity and calibrate monetary policy models. Without data, both private and public decision-making becomes less informed and more reactive.

At its core, the EMH was never a claim that markets are always right, rather, that they are informed by available data. Today, that assumption is crumbling. In the fog of a government shutdown and the euphoria of AI optimism, the notion of efficient markets looks more like an aspiration.

If efficiency relies on transparency, the current government shutdown reveals how fragile that efficiency truly is. Investors are not necessarily irrational, but they are currently uninformed. And in an age where algorithms and narrative move trillions, a market without data isn’t efficient, it’s aspiration-based finance.

Dr. Vange Hochheimer is a professor of economics and finance at Whitworth University and CEO of Grand Fir Analytics LLC.

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)