Home » Inland Northwest executive pay growth cools

Inland Northwest executive pay growth cools

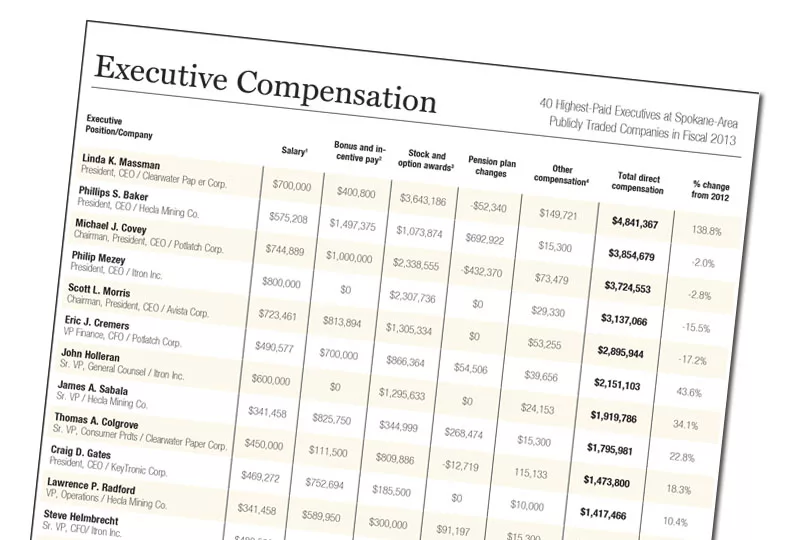

Average compensation remained flat in 2013

July 17, 2014

Total executive compensation at Inland Northwest publicly traded companies remained essentially the same in 2013 as it was in 2012, following double-digit increases in pay the previous three years, the Journal of Business’ annual analysis shows.

Average compensation for the 55 executives from 11 public companies headquartered in the Inland Northwest was $1.037 million in 2013. That’s down 0.2 percent from $1.039 million in average compensation for the same group of executive in 2012, according to the analysis, which is conducted using information those companies must disclose to the U.S. Securities and Exchange Commission in annual proxy statements.

A leveling in total pay follows average increases of 13.2 percent in 2012, 13.3 percent in 2011, and 17.9 percent in 2010. Total compensation last fell in the midst of the recession in 2009, declining by 3.6 percent.

The newest analysis includes three fewer companies than the previous year’s research due to long-established companies either having left the Inland Northwest or not being in existence any longer.

Coeur Mining Inc. moved its headquarters to Chicago from Coeur d’Alene last summer. Portland-based Umpqua Bank acquired Spokane-based Sterling Financial Corp. in a transaction that was completed this spring. Coldwater Creek Inc., of Sandpoint, filed for Chapter 11 bankruptcy in April and had its brand acquired the following month. Neither Sterling nor Coldwater Creek filed proxies before the changes took place.

Eight executives from those three companies were among the top 20 highest paid executives in 2012, and 11 had total annual compensation that surpassed $1 million, signaling that a number of formerly high-paying positions here are gone.

In 2012, 33 executives had total compensation that exceeded $1 million; in 2013, that number fell to 15.

The top-paid executive on the 2013 list, however, made more than the top-paid executive the previous year. Linda K. Massman, in her first full year as president and CEO of Clearwater Paper Corp., had $4.8 million in total compensation, which bested her predecessor, Gordon L. Jones, who topped the 2012 list with $4.6 million in total compensation.

Massman, who previously served as Clearwater’s president and chief operating officer, had a 139 percent increase in income, from $2 million in 2012.

Her appearance atop the list marked the third time in the 21 years that the Journal has been tracking executive pay that a woman came in at No. 1—and the first time since 2006. Georgia Shonk-Simmons, former president and chief merchandising officer at now-defunct Coldwater Creek, led all executives in total compensation in 2006 after being the first woman to top the list in 2000.

In all, six women finished in the top 40, and a total of nine—or 16 percent—were among the 55 named executive officers.

Roughly a third of the people on the list saw their compensation drop, while six were new to the list and didn’t have comparable data from 2012.

For the purpose of this analysis, total direct compensation includes salary, bonuses and annual cash incentive pay, the annual value of long-term incentives such as stock options, restricted share grants, and perquisites for what are referred to as named executive officers. In other words, the total compensation is dramatically higher than what they actually took home.

While total compensation was flat for executives in 2013, average annual salaries and bonuses increased 13.5 percent to nearly $533,000, up from just under $489,000 for the same group of executives the previous year. In 2012, average salary and bonus grew by a more modest 4 percent after having fallen by 4 percent in 2011.

In both 2011 and 2012, large gains in compensation came from stock award and options.

While active CEOs of the largest publicly traded companies here dominated the top five, all but Massman saw their total annual compensation decline in 2013. Phillips S. Baker, president and CEO at Coeur d’Alene-based Hecla Mining Co., ranked second with $3.9 million in total pay, down 2 percent from the previous year. Baker was followed by Potlatch Corp. Chairman, President, and CEO Michael J. Covey, down 2.8 percent to $3.7 million; Itron Inc. President and CEO Philip Mezey, down 15.5 percent to $3.1 million; and Avista Corp. Chairman, President, and CEO Scott L. Morris, down 17 percent to $2.9 million.

The bulk of those declines in compensation, however, involved reductions in stock awards and options, pension-plan changes, and other perks. Salaries for each person in the top five increased.

Other active CEOs on the list are Craig D. Gates, of KeyTronic Corp., ranked 10th with $1.4 million in total compensation; Glen M. Dobbs, of Mines Management Inc., 36th at $455,000; and Randall L. Fewel, of Northwest Bancorporation Inc., 37th at $393,000.

John G. Shanahan, CEO of Revett Mining Co., finished outside of the top 40, with $335,000 in total compensation.

Jeffrey D. Thomas, who stepped down from the top spot at Ambassadors Group Inc. in February 2013, finished 26th with $851,000 in total compensation. Of that, nearly $786,000 involved a separation payment. Anthony F. Dombrowik, who served as interim president and CEO at Ambassadors after Thomas’ departure but subsequently has left the company, came in 35th with $488,000 in compensation.

Jon E. Eliassen, who retired as president and CEO of Red Lion Hotels Corp. last fall, came in 34th at $503,000. His permanent replacement, Greg Mount, started last January and therefore doesn’t appear in 2013 data.

The highest paid executive who didn’t serve as CEO was Eric J. Cremers, who is Potlatch’s vice president of finance and chief financial officer. At about $2.2 million in total compensation, he ranks sixth overall on the list.

Newcomers who made the top 40 and didn’t appear as named executives officers in previous years include Danny G. Johansen, senior vice president of pulp and paper at Clearwater Paper, who ranked 25th with about $858,000 in total compensation; Russell Vanos, senior vice president of business development at Itron, 28th with $665,000; and Shannon Votava, vice president and general counsel at Itron, 29th with $654,000.

Monique Hayes, corporate secretary at Revett, finished lowest among named executives with $101,000 in total compensation.

The SEC approved rules in the mid-2000s that require companies to divulge more information about the compensation packages provided to their top executives, but they also include estimates of what some forms of the compensation are worth—or will be worth in the future. For example, amounts listed for grants of restricted stock and stock options use formulas to determine what the stock could be worth in the future for the executive.

The Journal doesn’t include in its analysis the gains executives earn in a single year from having past restricted stock vest or from exercising past stock options. By adhering to more stringent SEC disclosure rules, companies now include the current-year cost of such gains in their filings, so adding them in could be duplicative.

To access a .pdf of the whole list click here

Footnotes

1 Amounts can include compensation voluntarily deferred by an executive under a company deferral plan. 2 Includes amounts listed either as bonus or as other annual incentive pay. 3 Under SEC rules, these amounts generally represent the company’s fiscal 2013 expense for restricted stock and stock-option grants made to an executive. They don’t necessarily reflect the actual value an executive might ultimately receive from the awards. 4 Other compensation can include other long-term incentive payouts, directors’ fees, pension-plan value changes, and other miscellaneous compensation, including perks. 5 Jeffrey D. Thomas and Margaret M. Thomas resigned from Ambassadors Group Inc. in February 2013. 6 Jon E. Eliassen stepped down at president and CEO at Red Lion Hotels Corp on Aug. 12, 2013. 7 George Schweitzer’s employment terminated Oct. 7,2013.Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)