Home » Inland Northwest executive pay keeps rising

Inland Northwest executive pay keeps rising

Compensation increased at double-digit rate again

July 18, 2013

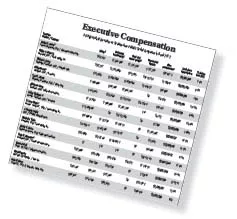

Total executive compensation at Inland Northwest publicly traded companies increased in 2012 at virtually the same double-digit rate as in 2011, the Journal of Business' annual analysis shows.

The 13.2 percent increase in average total compensation last year compares with a 13.3 percent jump in pay the prior year. In 2010, compensation increased 17.9 percent, after a 3.6 percent drop during a recession-ravaged 2009.

This year's analysis includes 69 executives at 15 publicly traded companies headquartered in the Inland Northwest, using information those companies must disclose to the U.S. Securities and Exchange Commission in annual proxy statements. Absent from this year's list is Gold Reserve Inc., which was delisted from the NYSE AMEX exchange earlier this year. For one final year, the analysis includes Coeur Mining Inc., which is in the process of moving its corporate headquarters to Chicago from Coeur d'Alene.

For 2012, those 69 executives received average total direct compensation of almost $1.2 million, up from $1.06 million a year earlier. Thirty-three of the executives, or nearly half, had total compensation that crested $1 million, and just under two-thirds of all named executives had an increase in total compensation.

Almost a quarter of the people on the list saw their total compensation decrease, and six were new to the list and didn't have comparable compensation data from 2011.

For the purpose of the analysis, total direct compensation includes salary, bonuses and annual cash incentive pay, the annual value of long-term incentives such as stock options and restricted share grants, and perquisites. In other words, the total compensation is dramatically higher than what they actually pocketed.

While total direct compensation increased by double digits for the third straight year, an analysis of salaries and bonuses alone—without stock awards and options, pension plan changes, and other compensation and perks—shows more modest growth.

Average annual executive salary and bonus in 2012 was $553,291, up 4 percent compared with $532,479 the previous year. This reverses the trend in 2011, when average annual salary and bonus fell by 4 percent compared with 2010.

In both years, the largest gains in compensation came from stock awards and options.

For the second consecutive year, the top paid executive last year no longer is an active executive in the Inland Northwest. Gordon L. Jones, former chairman and CEO of Clearwater Paper Corp., finished atop the list with almost $4.6 million in total direct compensation, including almost $1.9 million in salary and bonus. Consistently near the top of the list in recent years, Jones finished second on last year's list with $4.4 million in total compensation in 2011.

Last year, former Coeur d'Alene Mines Corp.—now Coeur Mining—chairman, president, and CEO Dennis E. Wheeler finished as the top paid executive with $7.2 million in total compensation, despite having resigned from his position in mid-2011.

Of the active executives on this year's list, Hecla Mining Co. President and CEO Phillips S. Baker Jr. finished with the highest total compensation, at $3.9 million. Rounding out the top five were Potlatch Corp. Chairman, President, and CEO Michael J. Covey, $3.8 million; Itron Inc. President and CEO Philip Mezey, $3.7 million; and Avista Corp. Chairman, President & CEO Scott L. Morris, $3.5 million.

Jones, Baker, and Mezey all had increases in compensation, while Covey's overall pay dropped by 6 percent. Morris' total remained essentially unchanged from 2011.

Jill Brown Dean, president and CEO of Sandpoint-based online retailer Coldwater Creek Inc., finished just outside the top five in the sixth slot. At $3.4 million in total compensation, she was the highest paid woman on the list.

Overall, five women finished in the top 40, and a total of nine—or 13 percent—were listed among the 69 named executive officers.

K. Leon Hardy, who retired as Coeur Mining's senior vice president and chief operating officer, was the highest paid executive who didn't serve as CEO. At $2.3 million in total compensation, Hardy finished eighth on the list.

LeRoy Nosbaum, who retired from the top post at Itron at the end of 2012, garnered the highest salary—other forms of compensation excluded—at $1.5 million.

Dennis C. Pence, Coldwater Creek's chairman and former CEO, had the lowest salary at $1. The bulk of Pence's $2 million in total compensation was categorized as other compensation. Overall, he ranked 11th on the list.

CEOs that don't appear in the top 40 highest paid are former Ambassadors Group Inc. CEO Jeffrey D. Thomas, who finished 41st; Red Lion Hotels Corp.'s Jon E. Eliassen, 45th; Idaho Independent Bank's Jack Gustavel, 47th; Revett Mineral Inc.'s John G. Shanahan, 48th; Mines Management Inc.'s Glen M. Dobbs, 51st; and Northwest Bancorp.'s Randall L. Fewel, 57th.

Thomas A. Vander Ploeg, the executive vice president and chief credit officer at Idaho Independent Bank who started with the company last November, finished at the bottom of this year's list with $24,000 in compensation for his weeks of employment there. His annual salary is listed as $175,000.

Of the executives who had spent a full year with their companies, Holly A. Poquette, senior vice president and chief financial officer at Northwest Bancorp., finished at the bottom with just under $140,000 in total direct compensation.

The SEC approved rules in the mid-2000s that require companies to divulge more information about the compensation packages provided to their top executives, but they also include estimates of what some forms of the compensation are worth—or will be worth in the future. For example, amounts listed for grants of restricted stock and stock options use formulas to determine what the stock could be worth in the future for the executive.

The Journal doesn't include in its analysis the gains executives earn in a single year from having past restricted stock vest or from exercising past stock options. By adhering to more stringent SEC disclosure rules, companies now include the current-year cost of such gains in their filings, so adding them in could be duplicative.

That said, executives in this year's analysis exercised stock options worth a total of about $800,000 and had vesting gains of about $18.8 million.

Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)