Home » Capital caution

Capital caution

Companies here weigh planned purchases against flat revenue

December 18, 2008

Under the shroud of a weak economy, companies here say they plan to cut back on capital outlays in the coming year.

Still, they say they'll buy what they need to remain competitive.

"I have to say (we plan) absolutely less capital expenditure," says Michael Senske, president and CEO of Pearson Packaging Systems, located on the West Plains. "We are being very conservative—with hiring in general, and with capital expenditures, such as new computers."

Capital expenditures generally include items with multiyear life spans, from computers and machinery to vehicles and buildings. Such purchases are considered one of the "fuel sources" for an economy, and upcoming capital budgets, sometimes called "capex" budgets, can portend business activity in the coming year for vendors.

For managers, setting capital budgets depends in part on projecting how business will be.

"It's one of those years when we have to make the calls to generate the work rather than having it come to us," says Kurt Runolfson, president of Interlink Advantage Inc., which designs network systems and provides Web hosting for companies here. Runolfson says Interlink's sales have been soft this quarter, and he expects that will continue through next summer.

Washington Trust Bank plans to spend about the same in 2009 as it did this year on computer-related technology, but will consider each purchase carefully to ensure that it's absolutely necessary, says Chris Green, director of IT infrastructure systems at the Spokane-based bank.

"We plan to stay as flexible as possible, and if conditions dictate some cutbacks, we'll be prepared to make them," he says.

Caution about expenses is tempered by companies seizing opportunities for growth.

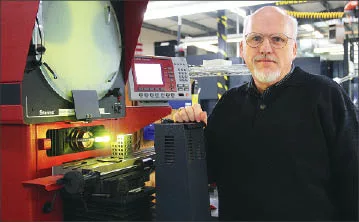

Spokane Valley-based MacKay Manufacturing Inc. spent $2 million on new equipment this year to meet increased customer demand and record sales, says President Mike MacKay.

"I don't see that we're going to spend much money next year, based more on the fact that we spent so much on capex in 2008," MacKay says.

Meanwhile, some additional capital expenditures at Pearson Packaging might be needed due to its recent acquisition of Goodman Packaging Equipment, which is based in the Chicago area. Pearson expects to add employees here as a result, and anticipates that additional software licenses and computer terminals will be needed here to accommodate them, Senske says.

In the past few years, Pearson Packaging has reduced its capital expenditures dramatically, by outsourcing the fabrication of some of the parts used in the packaging equipment it manufactures, he says.

"That was in anticipation of what was going to happen in the economy," Senske says. "It reduced our need for continued capital expenditures."

MacKay says two things drive capital expenditures at his contract manufacturing operation—replacing old equipment and adding equipment for growth. Most of MacKay Manufacturing's spending last year was driven by new sales, while the coming year's expenditures likely will be more along the lines of replacing aging equipment, he says.

"Most of our equipment has about a 10-year life span," MacKay says.

Currently, the company expects to spend roughly $600,000 on such replacements next year, though MacKay says that number could end up being as low as $300,000 or as high as $1 million.

"I see no change in our business based on the economy," he says, though like other companies, MacKay Manufacturing is being conservative in its revenue projections, anticipating a flat year in 2009.

Pearson Packaging also is hoping for growth, but is planning its capital expenditures based on its revenues next year coming in on par with 2008, not counting the impacts of the acquisition, Senske says.

"Obviously, we'll have the growth of the acquisition and combined with the acquisition we're doing a lot of new product development and feel we'll experience a fair amount of organic growth as well, but what we're spending to is a flat year next year with the addition of Goodman," he says.

Vendors hopeful

Wayne Williams, CEO of Liberty Lake-based Telect Inc., says the telecommunications maker is "preparing for the worst and working like crazy for the best."

Telect has reduced its own costs in recent years by downsizing its overseas sales operations and refocusing on North America. Now, Williams says, a reduction in new-home construction along with businesses pulling back on expansion plans has put the telecom industry on edge.

He says Telect's customers—wireless and wired-line telecommunication carriers—are hurting because their customers are hurting. Telect's revenues are flat overall for 2008 because of the falloff in the last six months.

"For the first half of the year, we were up around 10 percent over last year," Williams says, adding that he thinks business eventually will improve.

"I still feel good about the communications business" because wireless has become more of a need than an accessory, he says. Williams adds, however, that he worries Telect's customers might experience revenue shortfalls in 2009 because people don't want to spend money on new cell-phone technology.

Another vendor here, ABC Office Equipment Co., which sells and leases printers, copiers, and fax machines, is seeking to add market share, by adding sales staff, says Mike Brandon, its president.

"We've gone from being involved in 12 deals in August to 46 deals as of this morning," in large part because the company had five additional salespeople on board, Brandon said Dec. 12.

ABC's customers increasingly are focused on cutting their expenses, including reducing capital expenditures and saving on ongoing expenses such as toner cartridges for printers and copiers, Brandon says.

Some additional sales are being driven late in the year by companies that are seeking to take advantage of year-end tax benefits associated with cash purchases, Brandon says.

At Interlink, such end-of-year sales from customers have fallen off by about 20 percent this year, compared with the fourth quarter of last year, Runolfson says.

Also, he says, Interlink's customers these days increasingly are asking themselves if they can squeeze one more year out of their current computer equipment, and sometimes are choosing to spend money to upgrade older equipment to get more life out of it, rather than buying new equipment, he says.

Though such upgrades often mean that a company will spend a little more in the long run, they allow it to defer the bigger capital expenses until later, Runolfson says.

Right now, people are considering lower-cost IT solutions, he says. Interlink's most popular line of servers currently are those that run the Linux operating system, because it's one of the least expensive to get into, he says.

"Especially when money is tight, they are our best sellers," he says.

Latest News

Related Articles