Credit unions acquire community banks at record pace

Washington state leads the nation in credit union purchases of banks in 2024

Washington state leads the nation with six pending bank acquisitions by credit unions in 2024.

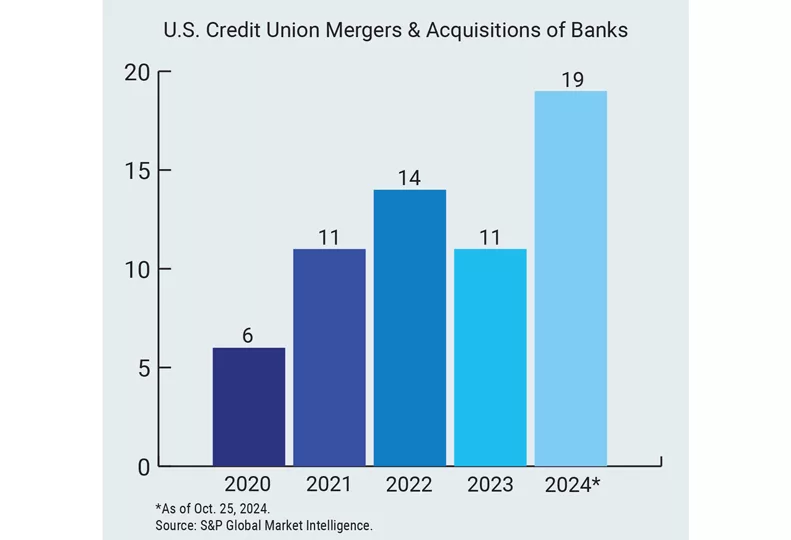

| Fia TartThe number of community banks acquired by credit unions nationwide has reached a record high this year, with 19 acquisitions announced year to date through Oct. 25, with a disproportionate number occurring in Washington state, according to market data by S&P Global Market Intelligence.

The trend is of concern to some bankers, however, who are calling on more federal oversight of the transactions.

Proponents are touting the benefits of the credit union acquisitions to consumers and communities, while critics are raising concerns about fairness, tax revenue loss, and the future of community banking.

Ezra Eckhardt, president and CEO of Liberty Lake-based STCU, says one reason credit unions are acquiring more community banks is that often, credit unions have more financial resources to invest in products and services that would be too expensive for a bank to provide to its customers.

Additionally, as banks close, there aren't many new community banks being chartered to replace them, which allows credit unions to grow to fill the space those banks have vacated.

"Credit unions are the community banks of 30 years ago," Eckhardt says. "(Banks) are closing branches in smaller communities and moving those branches and the resources to ... larger deposit markets."

Credit union acquisitions of banks in Washington state account for about 32% of the total bank purchases by credit unions nationwide in 2024.

Six of the 19 credit union-bank acquisitions have been announced in Washington state so far this year and are currently pending, including STCU's purchase of Joseph, Oregon-based Community Bank, as previously reported by the Journal.

The other five pending whole-bank acquisitions in Washington state this year include: Richland, Washington-based Hapo Community Credit Union's acquisition of Community First Bank, of Kennewick, Washington; Richland, Washington-based Gesa Credit Union's acquisition of Centralia, Washington-based Security State Bank; Tacoma, Washington-based Harborstone Credit Union's purchase of Mount Vernon, Washington-based SaviBank; Tacoma-based Sound Credit Union's acquisition of Washington Business Bank, of Olympia; and Anchorage, Alaska-based Global Federal Credit Union's acquisition of Renton-based First Financial Northwest Bank, according to information compiled by S&P Global Market Intelligence.

The Community Bank acquisition is the fifth bank purchase for STCU since 2019, says Eckhardt. The acquisition of Community Bank is pending regulatory approval and is expected to be finalized in the first half of 2025.

Once approved, the addition of $550 million in total assets from Community Bank will help STCU grow to about $6.4 billion in total assets, with 49 branch locations in Washington, North Idaho, and Eastern Oregon.

"For many community banks, this is a good time to consider selling," says Eckhardt. "The ability of the credit union to pay cash might also change in the future, so the timing works today, but it may not work forever."

STCU's acquisition of Community Bank currently makes economic sense for a few reasons, he contends.

Interest rates likely aren't returning to the historically long period of low rates, resulting in the compression of net interest margins for smaller banking institutions, which also cuts into long-term investment opportunities for those banks, he explains.

"In Community Banks' case, they have more investments and less loans," says Eckhardt. "The return on ... their investments just gives them less opportunities."

Some supporters of such acquisitions say that when banks decide to discontinue operations, a credit union acquisition is a logical solution to ensure a financial institution remains in the community, according to an article by Jim Nussle, president and CEO of America's Credit Unions, a financial services advocacy group, published in American Banker.

Eckhardt concurs, and says the STCU acquisition of Community Bank provides benefits for both organizations, including the continued operation of all 10 branches and the retention of all bank employees. Additionally, the bank's 18,000 customers will have access to STCU's competitive rates, products, and other resources.

Bankers' Concerns

However, the growing trend of credit unions purchasing community banks has ignited controversy in the financial industry. Some community bankers and trade associations are calling for increased federal scrutiny regarding bank purchases by nonprofit credit unions in an effort to create a level playing field, says Greg Deckard, CEO and board chairman of Spokane Valley-based State Bank Northwest.

"Credit unions aren't doing anything to violate the law. They're taking advantage of existing statutes to continue to grow," he asserts.

Some bankers have concerns about the loss of federal income taxes that occur when a credit union acquires a bank, Deckard says. They contend that lighter regulatory burdens provide an unfair advantage, enabling credit unions to pay more to purchase community banks.

For example, banks are subject to fair lending rules and the Community Reinvestment Act of 1977, which originally was enacted to address systemic inequities in access to credit. Federal and state-chartered banks must prove they are meeting the credit needs of the entire communities they operate in, including low- and moderate-income neighborhoods. Periodically, federal agencies will evaluate and rate a bank's performance. CRA ratings can impact a bank's eligibility to merge and acquire other institutions, according to the Federal Deposit Insurance Corp.

"Banks are exhausted with the regulatory burden," Deckard says. "And there is a cost to comply with that."

On top of that, banks have a fiduciary duty to maximize shareholder value when they decide to exit the market, which means that banks are obligated to accept the best offer, Deckard explains. This creates a market advantage for credit unions, which often are able to offer the highest price in cash.

Deckard adds that in the last 14 years, Washington state banking charters declined from 114 to 38 banks currently in operation.

"I don't feel like we're at risk of selling our institution. ... We're the second oldest remaining bank in the state of Washington, founded in 1902," Deckard asserts. "I feel like the community bank industry is dying of 1,000 cuts."

Credit unions pay property taxes, payroll taxes, and health care taxes, says Eckhardt, but they don't pay taxes on retained earnings because those earnings are passed along to members as dividends.

Eckhardt contends that when STCU offers cash to purchase a bank, it's derived from a combination of balance sheets from both the credit union and the acquired institution, whereas a bank's purchase offer typically involves paying in stock.

"We are not paying anymore to buy the bank," Eckhardt says. "(Banks) are paying bank stock, we're paying cash. They have to pay taxes on dividends and income. We don't pay taxes because we're not paying dividends."

As credit union-bank acquisitions increase, the FDIC has signaled that it may require credit unions to provide more data on proposed transactions, according to a final Statement of Policy on Bank Merger Transactions announced in September.

Congressional action also is being called for by some in the banking industry.

Rebeca Romero Rainey, president and CEO of the Independent Community Bankers of America, issued a statement in October calling for Congress to hold hearings and to consider an exit fee on these acquisitions to capture lost tax revenue stemming from the deals.

Deckard says, "In rural communities ... the number of our charters are going down and are at risk, because the law needs to be relooked at."

Referring to a 1951 congressional repeal of tax subsidies for mutual savings banks, he adds, "They had the same tax-free status that credit unions enjoy now, but in 1951, these mutual banks were doing banking services and small business lending. They strayed from their mission, so their tax subsidy was yanked."

Deckard contends that credit unions have expanded beyond their initial mandate of serving people of modest means and common bonds by broadening their eligibility requirements for membership.

The changing financial landscape will reshape the banking industry as the number of community banks decline alongside the rise of credit unions.

Ultimately though, the share of credit union-bank acquisitions is a fraction of overall bank acquisitions, accounting for 21% of bank acquisitions as of June 3, according to an analysis by Pacific Coast Bankers' Bank, a correspondent banking and advisory financial institution.

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)