Home » Niche lender in Spokane Valley reports that commercial lending activity is picking up

Niche lender in Spokane Valley reports that commercial lending activity is picking up

Company expects its SBA loan volume to rise in '14

January 30, 2014

Millwood-based Commercial Lending Northwest Inc., a tiny 15-year-old company that provides commercial financing services to businesses, including for bridge and conventional loans, says it expects to see lending growth this year, especially in the packaging of U.S. Small Business Administration loans.

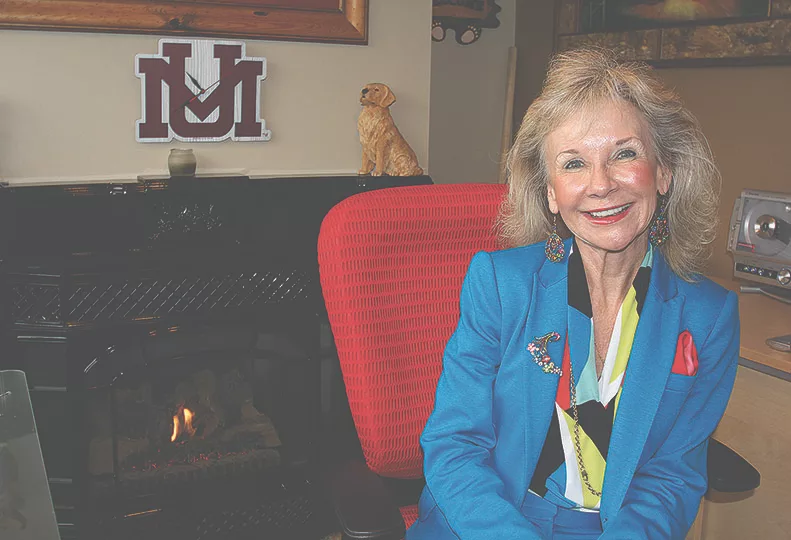

“I see optimism in virtually every sector of the business community,” says Margie Anderson, the company’s owner, president, and sole employee. She has two office companions daily, though, because she brings in her family’s pet goldendoodles, 9-year-old brothers Wilson and Logan.

Commercial Lending moved in November to an 800-square-foot brick building at 9015 E. Euclid, just west of Argonne Road, from slightly larger quarters at 9319 E. Trent. Anderson says she bought the commercial building from a private owner.

“It just economically made sense, and it’s cute,” she says. A back kitchen also serves as a conference room, and she adds, “I probably have two clients a day at the most, so I didn’t need a lot of space.”

Anderson says Commercial Lending books an average of $30 million a year in loans of various types, a level the company has maintained during most years.

Most of its clients are based in the Inland Northwest, but it also has some in Seattle, Utah, California, and Arizona. The types of businesses served are fairly evenly split between small concerns with fewer than 10 employees and large companies with about 200 employees, Anderson says. Very few are startups, with the majority of its clients having established businesses, including manufacturers, retail businesses, restaurants, and hospitality industry concerns, she says.

Anderson says she works with about 20 business clients a month needing loan services, typically arranging financing from $100,000 to $10 million. She says most concerns need the financing to restructure the liability side of the balance sheet to enhance cash flow.

Commercial Lending typically has more than $20 million to lend out at any one time, from a pool of funding sources.

Now that businesses are seeing longer term positive revenue trends, she expects the company to package about $10 million worth of SBA loans this year, up sharply from about $2 million last year.

Commercial Lending receives fees from the SBA or the eventual participating bank lender for its role in packaging such loans.

“For SBA loans, I have a neat community of banks that I work with here,” Anderson says.

Sometimes after reviewing the financials of the borrower and company, she says she might determine that the borrower wouldn’t qualify for an SBA loan but rather needs bridge financing.

She adds, “They haven’t quite turned the corner yet due to economic pressure. For banks, because of the regulatory environment we’re in, borrowers need to demonstrate two years of positive revenue trends based on tax returns.”

Overall, her company typically arranges financing to businesses that have modest to good credit, but they haven’t yet shown they’re profitable for two years. It also arranges loans for some first-time borrowers depending on their industry experience.

A bridge loan is short-term financing, and Commercial Lending typically structures such financing for lengths from 12 months up to five years, until a borrower can secure permanent financing. The bridge loans usually carry an interest rate of 6 percent to 9 percent. Bridge loans carry a higher rate of interest than longer-term conventional loans due to additional credit risk.

The company also writes up conventional loan applications for clients that are submitted to banks, and the interest rates for those loans usually are around 4.5 percent to 5.5 percent, if a business is established and has good cash flow, Anderson says.

Anderson founded Commercial Lending Northwest in 1998, after having worked for 18 years as a loan officer here for Washington Trust Bank and Bank of America.

From 2009 to 2012, she says, Commercial Lending remained busy, though some funding sources dried up due to risk and volatility in the market. She says the company relies on nontraditional lenders, or what she calls hedge fund lenders, to provide funding for the bridge loans the company writes up.

“They offer a variety of credit facilities we can put my clients into,” she says. “There is so much good quality funding that’s flowed back into the commercial lending arena. I’d say in the middle of 2013, they returned. I’m happy to report they’re back.”

While more funding options are available, Anderson says the other positive trend this year is that more small businesses are better positioned to seek SBA or conventional loans because of positive revenue trends since mid- 2012.

“Revenues have trended back up for a lot of local companies starting in 2012, and 2013 proved to be a way better year,” she says. “Not for all companies, but for a fair amount.”

She adds, “It’s all trending up now, but people in businesses have to be smarter, leaner,” she says. “Now banks are finally loosening up. They can only do what the financials say they can, but they’re seeing the same trends I am.”

She says securing bank financing in today’s lending environment isn’t as easy as it was in pre-recession years, but businesses still can secure loans based on projected revenues, with much depending on the business’s industry.

She adds, “I think more banks are going to still want to do SBA loans (in 2014) versus conventional loans because they are government-backed loans. Banks are so heavily scrutinized by regulators, they’re still being cautious. We’re not out of the woods yet, but there’s optimism.”

Anderson says that if a business client’s financials turned the corner six months ago and show a positive trend, Commercial Lending likely can arrange a bridge loan for that company.

As part of arranging loans, Anderson receives from borrowers their quarterly profit-and-loss statements and balance sheets, and often confers with a certified public accountant. She then helps the borrower develop a plan to cut expenses, increase market share, and forecast income.

Anderson says she will help a borrower transition from a bridge loan to a lower-interest loan as rapidly as possible.

“I love land development,” Anderson says. “That’s had a big comeback lately. Say someone has a large commercial parcel, and a client wants to put up an apartment building, restaurant, or athletic facility, and they need a loan, I get to be on the ground floor.”

As another example, she says a contractor called in January who needed $200,000 the next week, so his company could set up equipment to work on a $30 million development.

“He’s a well-known contractor,” she says. “Can you imagine what working on a $30 million development will do for his business? And he only needs $200,000. I can make that happen.”

During the recession, she says Commercial Lending’s ratio of arranging bridge loans to conventional loans was about 70 percent to 30 percent, but that scenario now is toward 60 percent to 40 percent.

“This was the most difficult, concerning recession I’ve seen companies go through,” Anderson says.

“I have clients who went from making $50 million a year in their business for 15 years to making $20 million a year, like that,” she adds, indicating a snap of the fingers. “I’ve seen a company making $16 million in a year going down to making $3 million a year. The work wasn’t out there.”

However, some of her clients that rely on income based on publicly-funded contracts, such as big road construction projects, are starting to see more of those jobs return, she adds.

Commercial Lending has remained busy largely through word-of-mouth referrals, repeat business, and longtime relationships with banks in the area.

The energetic Anderson says she is looking forward to settling into the new office, which she has decorated throughout with bear- and dog-themed pictures and figurines.

She earned a degree in business from the University of Montana in 1981.

“I’m a Griz,” she says about her office décor. “I love the gas fireplace. It’s cozy, don’t you think?”

Latest News Special Report Banking & Finance

Related Articles

Related Products

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)