Home » Tax planners eye options as Bush-era cuts near sunset

Tax planners eye options as Bush-era cuts near sunset

Obamacare provisions also scheduled to figure into returns for 2013

October 25, 2012

Tax preparers here say they're bracing for a frantic winter regardless of how the tax picture shakes out, as their clients take advantage of tax breaks for 2012 and start planning for big changes in 2013.

With the Bush-era tax cuts set to expire and Obamacare provisions coming into effect on Jan. 1, 90 percent of Americans could expect to be hit with tax increases next year, says Kevin Cox, principal at the Spokane office of Minneapolis-based LarsonAllen LLP accounting firm.

Without further action by Congress, "We expect the typical tax increase could be up to $3,500 per household," he says.

David Green, principal at David Green CPA PLLC, of Spokane, says he's not confident the Bush cuts will be extended for everyone.

"I think folks in the upper brackets should be wary about what might be the tax rate for 2013," Green says. "It only takes one party to say 'no' to a potential deal."

If Congress doesn't act, the highest federal income tax rate will jump to 39.6 percent next year from 35 percent currently.

Barring an extension of Bush tax cuts, the so-called marriage penalty will return. In that case, the standard deduction for married taxpayers filing jointly will decrease in 2013 to 167 percent—down from 200 percent—of the standard deduction for unmarried filers, a reduction of about $2,000 for typical joint filers, Cox says.

Higher-income taxpayers' personal exemptions, currently $3,800 per individual, will begin to phase out in 2013 at adjusted gross incomes of around $180,000 for single filers and $265,000 for joint filers, Cox says.

The maximum child tax credit for eligible filers is set to fall back next year to $500 per child from the current $1,000 per child.

The Earned Income Tax Credit also is set to revert to previous lower limits and max out at two child dependents.

A phaseout of certain itemized deductions, including employee job expenses and charitable contributions, will be limited for high-income filers to the greater of 3 percent of an inflation-adjusted gross adjusted income amount projected to be around $174,000 for joint filers, or 80 percent of the itemized value, Cox says.

Separate from the Bush cuts, an employee's share of payroll withholding taxes is scheduled to increase to 6.2 percent in 2013, up from 4.2 percent in 2012, and thed self-employment tax rate also is scheduled to increase 2 percentage points to 12.4 percent, Cox says.

Andrew McDirmid, a partner at Spokane-based accounting firm McDirmid, Mikkelsen & Secrest PS, says he doesn't expect 2013 tax rates will be set until early next year.

"Congress eventually will do something retroactive," McDirmid says. Otherwise, "Everyone would see a tax increase at the personal level. I don't think anyone wants that to happen—at least for most people."

McDirmid says he's advising many clients to hold off on certain tax decisions at least until after the presidential election.

Among items clients can plan for now, though, are new Medicare contribution taxes on unearned income and an additional tax levy on wages for high-income people that are scheduled to kick in next year to help fund Obamacare.

Under the Patient Protection and Affordable Care Act, a 3.8 percent Medicare contribution tax will be assessed on adjusted gross and net investment income in excess of $200,000 for single filers and $250,000 for joint filers.

If the Bush cuts expire, the Medicare contribution would bring the long-term capital gains rate to 23.8 percent and the rate on dividend income for some high-income filers to 43.4 percent.

An additional 0.9 percent Medicare tax on wages and self-employment income in excess of $200,000 for a single filer or $250,000 for joint filers also is scheduled to go into effect next year, McDirmid says.

For that reason, people in high tax brackets might want to accelerate income this year to reduce their tax liabilities next year, Green says.

With capital gains rates set to go up to 20 percent or higher if the Bush cuts expire, some people will be looking to harvest gains in 2012, he says.

Green, cautions people, however, to look closely at the underlying market to see if they want to hold certain assets for the long term rather than sell them off for the purpose of avoiding future tax increases.

"It's important to have a joint conversation with an investment adviser as well as a tax adviser," Green says. "I'm reluctant in many cases to let the tax tail wag the dog, so decisions shouldn't be made in a vacuum."

Cox says some businesses that are planning to make cash distributions might want to do so in December while they're still in the 15 percent bracket, rather than wait until January when total taxes on distributions could exceed 40 percent for higher-income clients.

Some people might want to sell some security vehicles, such as mutual funds, now to take advantage of this year's capital gains rates, and immediately buy similar mutual fund to restart clock on gains, Cox says.

It's not allowable, though, to sell and repurchase the same security, such as an individual stock, unless the seller waits more than 30 days to repurchase it, Cox says. "If you sell a single stock and buy it back within 30 days, it doesn't count as a sale," he says.

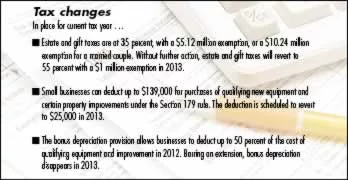

Cox says he's advising some small business owners to consider two provisions that would enable them to deduct the cost of qualifying equipment and certain improvements from their 2012 taxable income.

A Section 179 provision allows small businesses to deduct up to $139,000 for qualifying equipment and real estate. For the 2013 tax year, that's scheduled to revert back to $25,000.

Additionally, a bonus depreciation provision allows businesses to write off up to 50 percent of the cost of qualifying equipment and improvements in 2012. Barring congressional action, bonus depreciation disappears next year, Cox says.

With that in mind, the tax savings this year might be enough of an incentive to buy equipment now rather than wait, Cox says.

McDirmid says that, moving forward, it will be increasingly more important to identify income that should be treated as active income rather than passive income.

For example, if a business leases property from a related company, and the business and property owner can be grouped as one entity, the rental income might be eligible to be treated as active income, which wouldn't be subject to the 3.8 percent Medicare tax on unearned income, he says.

"What preparers are doing is looking at passive income and studying whether it's truly passive or whether there is a legal way to treat it as active income," McDirmid says.

People holding conventional individual retirement accounts who want to guard against the prospect of rising tax rates might want to consider converting the accounts to Roth IRAs before year-end. The account holders would pay a certain amount in taxes now, but at retirement age, income from Roth IRAs would be tax-free.

Those who do convert to Roth accounts have until Oct. 15, 2013, to change their mind if the tax environment changes, assuming they file for an extension for their 2012 returns, McDirmid says.

Not all camps are sold on Roth IRAs because no one knows what the tax environment will be in 15 to 20 years, he cautions. He adds, though, that "Having an essentially tax-free annuity for yourself, children, and grandchildren down the line is pretty compelling."

Green says another area of abundant uncertainty is the fate of the estate tax and lifetime gift exemptions

Under the current tax code, each individual is allowed a $5.12 million exemption from taxes for lifetime gifts and estate value combined. The 2012 estate tax rate for values exceeding the current exemption is 35 percent.

That's scheduled to shrink to $1 million in 2013 if Congress can't agree on extending it, Green says. Barring congressional action, the value of an estate in excess of $1 million would be taxed at 55 percent, he says.

The current 2012 law applies to gifts as well as estate values, Green says.

"Some of my very-high-bracket older clients in their late 80s or early 90s have been giving away some or all of that $5 million during 2012," he says.

Cox says that beginning in 2013, there's no allowance to transfer the unused portion of the gift- and estate-tax exemption between spouses, as is currently allowed. "If I die in 2013, my spouse can't claim the exemption not used by me," he says.

McDirmid says the lifetime gift exemption is advantageous for some high net-worth residents in Washington state, which doesn't have a gift tax but assesses a 19 percent tax on the value of an estate exceeding $2 million for an individual.

"The election is going to give taxpayers a better idea of what's going to happen in 2013," McDirmid says. "November is going to be a very busy time for CPAs."

Up Close

Related Articles