Home » Rate of all-cash homes sales in Spokane surge

Rate of all-cash homes sales in Spokane surge

Investors often request discounts in exchange for accelerated closings, industry experts say

March 29, 2012

The percentage of Spokane-area homebuyers paying all cash has more than doubled since 2009, paralleling a national trend that's mostly attributed to investors taking advantage of low-priced and distressed properties.

Some observers of the homebuyer market say that's contributing to the downward pressure on home values, because sellers often concede discounts to cash buyers in exchange for quick closings. Others say such sales are helping to reduce inventory, which is needed to stabilize values.

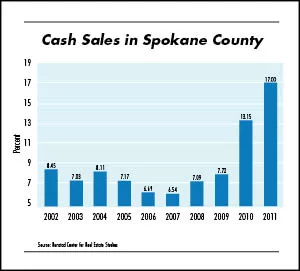

In 2010 and 2011, respectively, 13.2 percent and 17 percent of homebuyers in Spokane County paid all cash, compared with 7.7 percent in 2009, says Glenn Crellin, Seattle-based associate director for research at the University of Washington Runstad Center for Real Estate Studies.

In the first two months of this year, cash sales remained elevated at 15.5 percent of all home sales in the county.

Prior to 2010, cash sales peaked at 8.45 percent in 2002 and since then were lowest at below 7 percent in 2006 and 2007, during the most recent years of steep rises in home prices.

Crellin is tracking the trend here through data collected by the Spokane Association of Realtors Multiple Listing Service, although he says it's similar statewide.

"We're seeing substantially more cash transactions in the last couple of years in terms of historic averages," he says.

Nationally, cash-only sales also have been trending upward, topping a third of all home sales in January, roughly twice the rate of cash sales in 2008, when the housing market stalled, according to surveys conducted by the Campbell/Inside Mortgage Finance HousingPulse tracking survey.

Crellin attributes the cash-only trend to growing investor participation in the marketplace.

"Investor groups or single individuals are taking up property as investments to either rent out or make more attractive," he says.

Those intending to resell, though, aren't the "flippers" that played a role in the real estate bubble that popped here in 2008. These are more sophisticated investors who recognize value, Crellin says.

Some cash buyers are looking for alternatives to other types of investments and savings vehicles, which currently pay low rates, he says.

"Unless they're going into the equity market, they aren't going to get anything out of savings," Crellin says.

Bruce Hardie, broker at Keller Williams Realty Spokane, also attributes the increase in cash transactions to experienced investors looking for value in a down market.

"Some cash buyers are people who see opportunities to fix them and sell them again," Hardie says. "Others are people who want to buy and hold them."

Investors who plan to rent out properties are taking advantage of prices that will allow them to realize a positive cash flow quickly from the rentals.

"That's what put investors back in the market," Hardie says. "We're seeing more seasoned investors who disappeared when the market was hot. They aren't really speculators."

In the years leading to the peak median sales price here of $185,000 in 2008, home prices climbed faster than incomes, creating an affordability gap that has since been closing, he says, adding, "Speculators didn't understand that process as well."

Some cash buyers see value in homes that conventional lenders wouldn't touch, Hardie says. For instance, lenders wouldn't finance a home that doesn't have a working furnace, he says.

"If it doesn't have heat, you can't get a loan, because you can't get it appraised," he says.

A cash buyer willing to invest in repairs or a new heating system, in this instance, often would be able to offset those expenses by negotiating discounts, he says.

Those cases aren't affecting homebuyers with owner-occupied financing, however, he says.

"Pre-approved buyers are viewed the same as cash buyers," Hardie says. "They aren't being harmed by an influx of cash."

Rob Helgesen, assistant vice president of Spokane Valley-based Numerica Credit Union's Home Loan Center, concurs with Hardie's assessment. He says credit unions and banks have a lot of money in deposits, and they're competing for borrowers with near record-low loan rates.

"Unless someone wants to sell in under 30 days, a well-qualified borrower interested in a house that has no major issues would win as much as the cash buyer," he contends.

At certain price points, however, Hardie says, prospective buyers likely will see competition, whether they plan to pay through a conventional mortgage or with cash. He adds that it's getting more common to see multiple offers for homes here priced below $125,000.

"There's more demand for lower-priced homes, certainly for anything under $100,000," he says.

In January and February combined, 475 homes were sold through the Spokane MLS, which is the highest January-February total since 2008 and up from 374 during those months last year.

Home values, though, have continued to fall.

The median sales price in February was $145,000, down from $152,645 in the year-earlier month, and 18.1 percent lower than in February 2008.

In a recent article on the national trend in cash home sales, Fortune Magazine, reported that cash-only sales are contributing to downward pressure on already deflated home prices, because sellers in such transactions are accepting an average 10 percent discount in exchange for comparatively quick, hassle-free closings.

Rob Higgins, executive vice president of the Spokane Association of Realtors, says distressed sales are contributing most to declining sales prices and the ensuing cash-buyer trend.

Distressed sales include foreclosed, bank-owned, and short-sale properties, which are sold in urgent situations, often at a loss.

About 22 percent of home sales here in 2011 were foreclosed properties. In 2008, less than 5 percent of sales through the MLS were foreclosed properties.

"Whenever a lot of foreclosed properties are on the market, we tend to get investors purchasing for cash," Higgins says.

Regardless of whether cash sales affect home prices, the best way to stabilize the market is to reduce inventory, and Numerica's Helgesen says one positive aspect about cash buyers is that they're helping to reduce the housing inventory.

"If houses sell at discounted rates, at least it's stimulating the market," Helgesen says. "It doesn't help property values in the neighborhood, but hopefully it creates a sense of urgency."

Unlike experienced real estate investors, a lot of prospective first-time homebuyers have only eyed the market during the last few years of declining values, and it's difficult for them to envision values returning, he says.

Any show of confidence in the market could nudge them off the fence, he says.

"We think it's a great opportunity, now," he says. "With low rates, it presents an opportunity they might not ever see again."

The Spokane MLS reported about 2,380 active listings as of March 2, down from 2,660 a year earlier, although prices haven't responded to the drop in listings, Higgins says.

"Nobody's quite sure how much inventory is out there," he says. "We've got to work our way through distressed sales to get back to a more healthy market, and that's going to take awhile."

Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)