Home » Real estate said heading to price stability in 2012

Real estate said heading to price stability in 2012

December 15, 2011

Residential and commercial real estate sectors could see some market recovery as buyers take advantage of fallen prices and low mortgage interest and continue to pare down the recession-related glut of properties for sale, industry sources here say.

Judging by this year's reduction in listings, 2012 might bring some stability to residential real estate prices, which have fallen for four straight years, says Rob Higgins, executive vice president of the Spokane Association of Realtors.

"One positive sign for residential real estate sales in Spokane County is that we're whittling down our inventory," Higgins says.

As of October 31, the inventory was down 12 percent compared with a year earlier, he says.

"We're seeing progress on that," he says. "It means we should see prices begin to stabilize next year" he says.

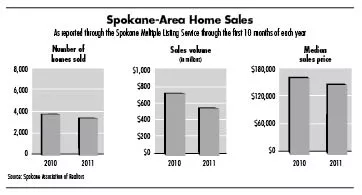

For the first 10 months of this year, the median sales price for homes sold through the association's Multiple Listing Service was $155,000, down from $165,000 for the same period last year. About 3,300 homes were sold in Spokane County through the Spokane MLS in the latest 10-month period, down from about 3,600 homes in the year-earlier period.

Home sales were up an average of 12.5 percent, though, in each month of the four-month period of July through October compared with the year-earlier period.

Current depressed prices and historically low mortgage interest rates are contributing to high rankings on the affordability index.

"I can't recall affordability ever being better," Higgins says. "With interest rates where they are, it should be a good market. I think we're going to see improvement next year."

A slow economic recovery with persistent high unemployment, however, remains a troubling factor for the residential real estate market, he says.

Ken Lewis, owner of Spokane Valley-based Prudential Spokane Real Estate, believes real estate prices and mortgage rates are as low as they can get.

Lewis says some business owners will see opportunities to reduce overhead by buying property rather than paying rent.

"Just like residential, commercial real estate prices have bottomed out, and there are good products on the market now," he says.

Jeff Johnson, a principal with NAI Black, a prominent Spokane commercial real estate brokerage, says several national retailers are checking out Spokane for affordable retail space.

"We have more activity with national chains than with local retailers," he says, although he adds that a number of local or new-to-Spokane operators are looking for restaurant and brewpub locations.

Out-of-state investors also are looking to Spokane to invest in multifamily housing after a multiyear lull in that sector, Johnson says. "That's a sign of good things to come," he says.

Johnson also says he anticipates continued demand in the industrial-space sector, especially for spaces in the range of 10,000 square feet to 20,000 square feet.

The most challenging sector of the commercial real estate market is office space, Johnson says.

"Companies are taking advantage of lower rents and doing the musical-chair routine to get into nicer buildings for the same or lower rent," he says.

To own the buildings they occupy, small businesses in the market are taking advantage of U.S. Small Business Administration-backed financing opportunities, which require as little as 10 percent down for loans typically in the range of $200,000 to $1 million, he says.

Latest News

Related Articles

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)