A slowing labor market reflects a slowing economy

Spokane County should mirror state's expected tepid growth in payroll employment in 2026

The labor market outlook for 2026 for the state of Washington looks very challenging, if we are to believe the recent estimates from the Washington State Economic & Research Forecast Council (Council).

While payroll employment statewide in 2024 grew by 1%, the Council looks at this year delivering a mere 0.3% annual growth. And 2026 is viewed even more conservatively. The Council expects a bump in state payroll employment of only 0.2%! In colloquial terms, that’s called treading water.

As the state goes, so does Spokane County. A simple correlation of employment (by residence) between the state and the county shows a high degree of movement together. The correlation coefficient calculated over the 2010-2024 interval was 0.97. Spokane, then, should share the same outlook as the state--little growth in the number of employed.

The local outlook is, in fact, a continuation of a recent trend. Last year brought a gain in employment of about 1,650 in the county, or 0.7%. In 2023, the gain was weaker, at about 1,100, or 0.4%. One needs to go back to the years immediately preceding the pandemic to find robust job creation here. For example, in years 2016-2019, the average annual growth of employment in Spokane was 3.3%.

In the face of a growing population, sluggish job growth here should lead to higher unemployment rates. Recent history doesn’t bear this out, as the county unemployment rate in 2023 fell from 4.8 to 4.2%. True, it rose in 2024 to 4.5%, but the differences between the years are small enough to be largely statistically a wash (not significant).

Why shouldn’t the rate increase higher in the face of such tepid employment gains? Largely because the local workforce is not growing very fast, or at all. Workforce numbers include both the number of employed and those not employed but looking for a job. Since 2020, estimated county workforce has increased by about 2,600. Over the same five years, county population has grown by about 10,000.

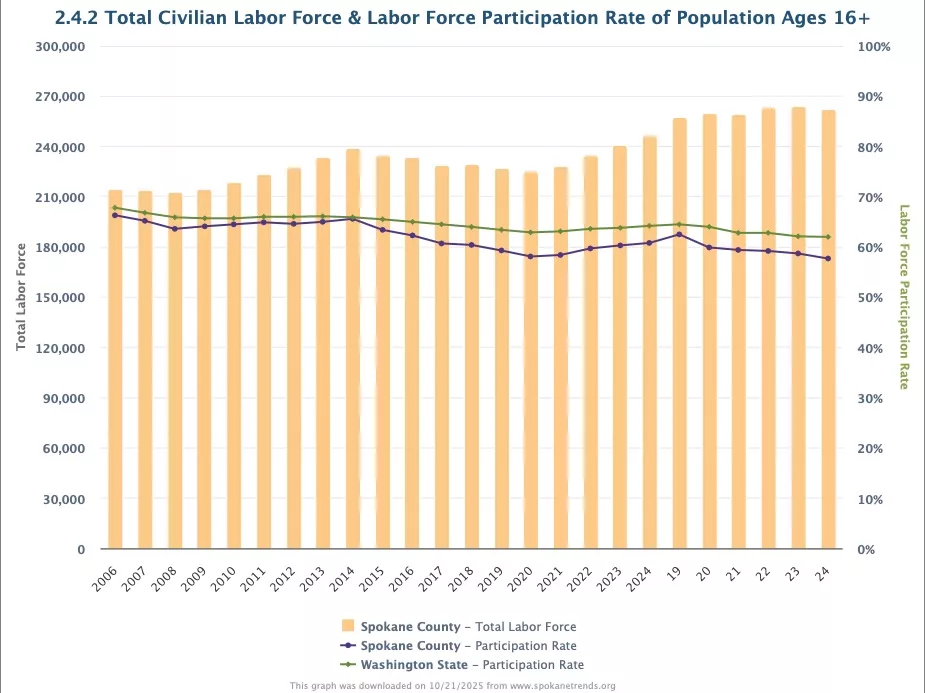

This dichotomy – a population growing at a good clip but a workforce growing much more slowly--is reflected in the county’s declining workforce participation rate. This is simply the ratio of the number in the workforce to the number of adults (years 16+) in the population. It measures the willingness of the local population to gain employment and its corresponding wages.

The local ratio peaked recently in 2016 at 63%. Since then, it has fallen to about 58% in 2024.

The falling participation rate reflects a few factors. The most obvious one is the growing share of older adults in the population. Most, but certainly not all, older adults have retired. The share of this age group in 2024 was 19%. In 2019, it stood at 17%, and in 2015, at 15%. Yes, this community is a far cry from a Japanese-style demographics, with its huge proportion of elderly.

But given the size of the baby boomer generation hitting older adult status, the share of 65+ population will continue to grow. And with that growth, participation in the local labor force should fall further.

On the other hand, the work mandate of Medicaid recipients may counteract the aging of the county’s population. Census has recently estimated that about 44,500 county residents ages 19-64 currently depend on Medicaid.

For the next year, it is likely outside of a few occupations like nursing, the job market and hence overall employment will remain muted. With a relatively low labor force participation rate, the county’s supply of workers to meet tepid demand should be adequate.

For 2027, the state ERFC is forecasting an economic rebound of sorts for the state. Growth in personal income and payroll employment will pick up, with the latter regaining the rate (1%) enjoyed in 2024. Spokane County should expect much of the same.

Dr. Patrick Jones is executive director of the Institute of Public Policy & Economic Analysis at Eastern Washington University.

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)