Uncertainty remains the watchword, and likely will continue in 2026

Overwhelming feedback from employers is that decisions on hiring or investments as slowed or halted.

* Spokane metro Construction includes mining and logging, which are relatively small employers. In Kootenai Metro, Healthcare and Social Assistance includes private education, which is a relatively small employer.

Hard to believe 2025 has expired so quickly but, in my case, this likely reflects the time distortion that haunts an aging economist. The most pressing economic concern in 2025 was policy uncertainty—uncertainty around tariffs, taxation (both federal and state), immigration, government spending (the One Big Beautiful Bill Act and recent government shutdown), and Federal Reserve independence.

The extreme uncertainty of COVID has simply shifted to state and federal economic policy uncertainty.

My conversations with Northwest employers have all been centered on this new source of uncertainty and how it is impacting them, especially in the private sector. The overwhelming feedback is that it has slowed or halted hiring and investment decisions. Early in the year, the primary driver was a combination of new tariffs and uncertainty over future tariff policy. As we moved into the second half of the year, all the other non-tariff uncertainties started weighing on expansion decisions.

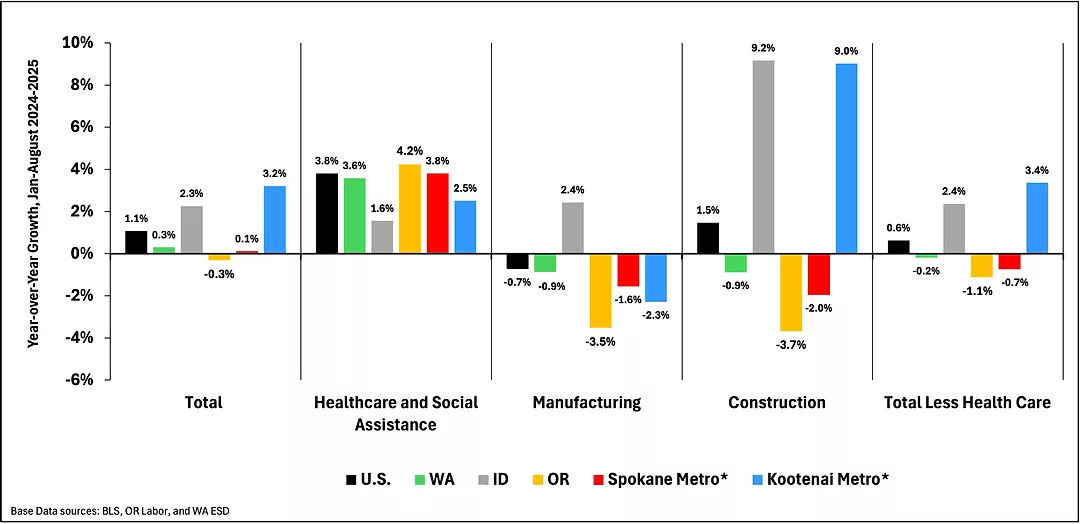

The impact of this can be seen in revised employment numbers, which show weaker growth compared to earlier releases. If we look at employment growth from the first eight months of last year to the first eight months of this year, growth has been weak in the U.S, Washington, and Oregon (see chart). Only Idaho continues to show relatively strong growth on year-over-year basis. Still, even in Idaho (including Kootenai Metro), month-to-month employment gains slowed in the spring.

If we break out the healthcare, manufacturing, and construction sectors, several important trends emerge. First, healthcare employment has been the sector growing the fastest in the U.S. and Northwest—this is also true if one looks at the metro level, including Spokane Metro. In comparison, the manufacturing and construction sectors look weak, especially in Washington and Oregon.

If healthcare employment is removed from total employment, growth for the U.S. and most of the Northwest looks even weaker. If healthcare hiring stalls in 2026, then total employment growth would weaken further. Given the healthcare sector’s public comments concerning impending spending cuts, there are reasons to be concerned about this sector heading into 2026, especially in the Inland Northwest’s rural areas.

It's worth pointing out that Idaho’s relatively stronger performance partially reflects the state’s more stable and favorable business policies compared to Washington or Oregon. I say, “partially,” because Idaho’s economic growth continues to be fueled by in-migrants moving to the state, including North Idaho. A recent business trip to Sandpoint was a reminder about how many people have moved to the Sandpoint-Coeur d’Alene-Post Falls corridor.

The combined Spokane-Kootenai Metro continues to outpace population growth in the U.S. Census estimates for 2024 show the combined metro area grew at 0.8%, with the U.S. growing at 0.5%. The largest contributor continues to be Kootenai, which grew at 1.7%, while Spokane was at 0.6%. That said, the Census estimates show regional population growth has slowed.

If employment growth continues to slow, this will put downward pressure on future population growth—typically, regional population growth will slow as employment growth weakens, especially if it weakens faster than the U.S. as a whole. This reflects the importance of regional economic opportunities to attract new residents. With slowing employment growth, I expect population growth will continue to slow in 2026.

Although a more moderate pace of regional in-migration would reduce the pressure on home prices and rents, housing affordability will remain a problem for the foreseeable future.

For the region to regain housing affordability, it needs to see some combination of a large increase in new residential units and a significant decline in existing home prices and rents. However, supply and high prices are not the only problem impacting housing affordability. As we observed again this last summer, wildfires and rising insurance costs will remain with us. Insurers all over the country continue to re-evaluate pricing and the products offered to high-risk areas.

Although the labor market is slowing, it’s too early to say if we are headed to a recession. Unfortunately, a protracted government shutdown that reduces economic data releases will make it that much harder to identify how close we are to a recession.

That said, the potential shocks that could lead to a recession are all too familiar: policy uncertainty, political instability and gridlock at home, political instability abroad. Concerning political instability abroad, the Gaza ceasefire will hopefully reduce the risk of a wider conflict in the Middle East; however, growing tensions between Europe and Russia, the ongoing trade conflict between the U.S. and China, and the unresolved issues with Iran and its nuclear program are risks that bear watching in 2026.

Dr. Grant Forsyth is the chief economist at Avista Corp. and previously was an economics professor at Eastern Washington University.

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)