Home » SBA lending in Spokane District reaches $226.7 million

SBA lending in Spokane District reaches $226.7 million

Restaurant, hotel, gas stations account for bulk of activity here

November 8, 2018

Total lending backed by the U.S. Small Business Administration in the Inland Northwest rose $8.3 million through fiscal year 2018, data compiled by SBA indicates.

Loans backed through the Spokane branch of SBA’s Seattle district in fiscal year 2018, which ended Sept. 30, totaled $226.7 million, up from $218.4 million in fiscal year 2017, the recently released data show.

Additionally, the total number of loans issued also increased to 508 in 2018, from 491 in 2017.

The Spokane branch covers 20 Eastern Washington counties and 10 northern Idaho counties, including Spokane and Kootenai counties.

SBA doesn’t issue loans, but guarantees a portion of loans, which reduces the risk for conventional lenders to issue such loans, says Kerrie Hurd, SBA’s Seattle District Director.

SBA-backed loans are capped at $5 million, says Hurd.

The organization will back “just about anything a business would need,” including land and facility costs, equipment purchases, and lines of credit, Hurd says.

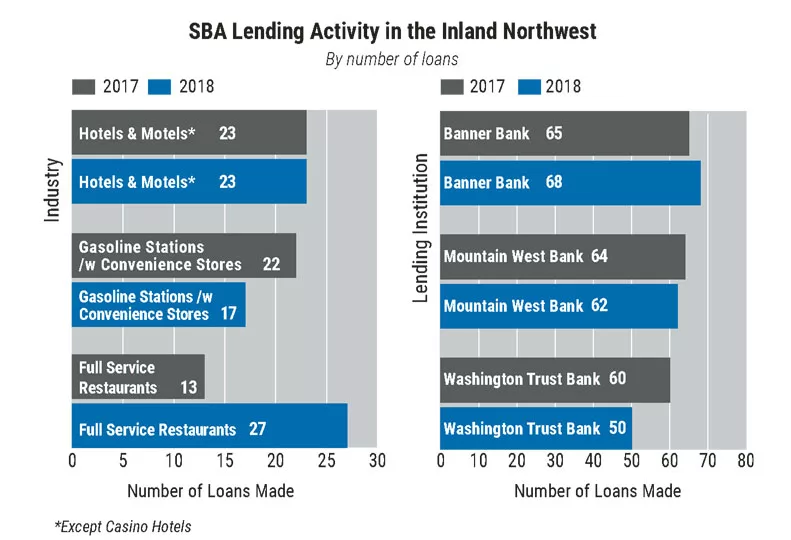

Full-service restaurants led 10 industry categories in the number of loans with 27 SBA-backed loans totaling $9.6 million made throughout the Spokane branch in 2018, up from 13 loans totaling $4.1 million in 2017.

The large jump in loans made in that category could indicate that restaurants might be expanding, or they might be transitioning ownership, Hurd says.

In terms of dollar volume, the hotels and motels topped the industry categories in 2018 at $45.4 million among 23 loans, compared with $40.6 million in 23 loans in 2017.

The number of loans for gas stations with convenience stores also ranked highly for both fiscal years, with 17 loans valued at $17.8 million and 22 valued at $26.8 million issued, in 2018 and 2017, respectively, SBA data show.

Limited-service restaurants, which Hurd says includes fast food eateries and food trucks, ranked fourth for the most loans issued in 2018, at 12 loans made totaling $500,000, or an average of $41,700 per loan. That category ranked third in 2017, SBA data show.

Also notable, nine loans totaling $800,000 were made to the logging industry in 2018, according to the data, a category that didn’t register as a top industry in 2017.

Through 2018, Hurd says SBA worked on getting more capital in rural areas.

“We have another deliberate effort to push in that direction for 2019,” she says.

Hurd says economic development within the Spokane branch has been more spread out than just Spokane and Kootenai counties.

“The capital is getting in the hands of the entrepreneurs across the region, and I think that’s a good trend for broad-based growth, maybe in communities that haven’t had some in the past few years,” she says.

Hurd says the economy remains strong.

“What we’re hopeful for is that that will continue to grow,” she says.

SBA also believes the Trump administration’s tax cuts will foster business development as well, Hurd contends.

“We believe that the president’s tax cuts and deregulatory agenda is going to help more small businesses grow and prosper in this coming year,” she asserts.

In both 2018 and 2017, Walla Walla, Wash.-based Banner Bank, Coeur d’Alene-based Mountain West Bank, and Spokane-based Washington Trust Bank made the largest number of SBA loans through the Spokane branch.

Banner Bank issued 68 SBA loans totaling $6.1 million in 2018, compared with 65 loans valued at $7.3 million in 2017. Coeur d’Alene-based Mountain West Bank issued 62 such loans totaling $17.7 million in 2018, compared with 64 loans totaling $24.1 million in 2017. Washington Trust Bank issued 50 SBA loans valued at $18 million in 2018, compared with 60 loans totaling $10.4 million in 2017.

In Spokane County alone, Mountain West Bank made the highest number of loans in 2018, at 25 for a total volume of $5.1 million, according to SBA’s data.

In addition to backing loans, Hurd says SBA services also include business counseling, training, and Lender Match, an online platform that helps connect borrowers and lenders.

Latest News Special Report Banking & Finance Government North Idaho

Related Articles