Home » Spokane County tax bills top $500 million for first time

Spokane County tax bills top $500 million for first time

Total property valuation drops for third straight year

March 14, 2013

Total property value in Spokane County declined for the third consecutive year in 2012, while total taxes levied for 2013 based on that value topped a half-billion dollars for the first time, county records show.

Meantime, the number of property owners who contested their assessments has dropped dramatically, says Spokane County Assessor Vicki Horton.

Spokane County's total assessed value in 2012 was $36.4 billion, down nearly 3 percent from a year earlier.

The total tax levy for 2013 is $501.8 million, up 1.4 percent from the 2012 tax year.

Assessments for property taxes due this year are based on last year's valuations. The county mailed out 2013 tax notices on 223,812 parcels last month, and the first-half payments are due April 30.

The county has 56 taxing districts, which includes school districts, fire districts, cities, libraries, and roads. Some districts overlap, creating 221 unique tax code areas, says Connie Kline, a levy specialist with the county.

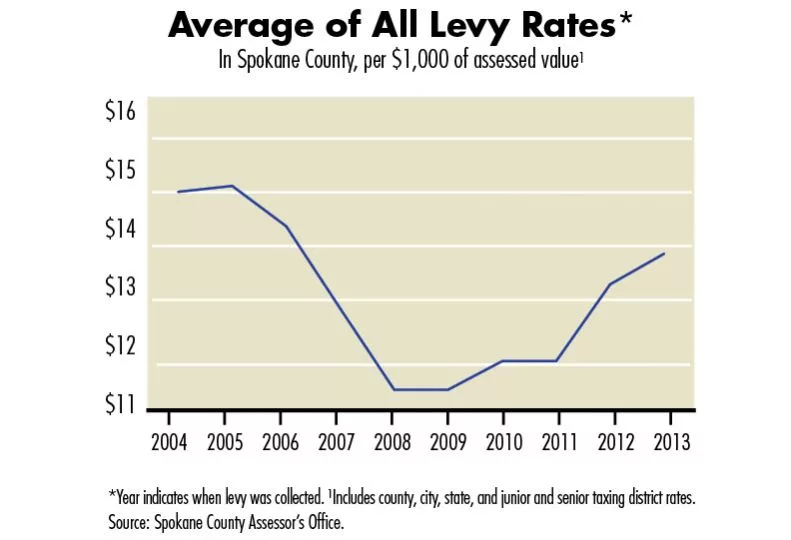

The average 2013 property tax rate in Spokane County is $13.86 per $1,000 valuation, up 59 cents compared with the average property tax rate in the 2012 tax year. Under the average 2013 levy rate, a typical assessment for a home valued at $160,000 would come to $2,217, up $94 compared with a home of the same value a year earlier.

Various school levies likely are major contributors to the average increase in 2013 tax rates, Kline says.

"Most of the school districts passed new levies that are all beginning," she says.

State and local schools will receive 57 percent of property taxes the county collects in 2013, followed by incorporated cities, which collectively will receive 16 percent.

The assessed value of the county has been falling since 2009, when it peaked at $38.8 billion. The last time the total tax levy fell was 10 years earlier.

Horton, who was elected to office in 2010, says appeals on 2012 property assessments totaled just more than 1,800, down from about 3,500 a year earlier.

The drop in the number of appeals occurred in part because the economic downturn was still weighing down appraised values, and in part because the Assessor's Office has implemented measures to ensure fair appraisals, says Horton, a longtime appraiser prior to being elected county assessor. Under Horton, the Assessor's Office has tweaked appraisal methods to factor in trends in neighborhoods, census tracts, and larger market areas for each property, she says.

"There are different ways to make sure the property owner is being treated equitably," Horton says.

Appeal hearings on 2012 assessments were completed last month, says Joe Mann, chairman of the Spokane County Board of Equalization. Last year, it took two months longer to hear appeals on 2011 assessments.

The Board of Equalization is responsible for assuring valuations reflect fair value. The six board members are appointed by Spokane County commissioners, although the board operates independently under supervision of the Washington state Department of Revenue.

"My perception is that a lot more appeals were settled by the Assessor's Office early on, so we didn't have as many hearings," Mann says. "We finished as early as we've ever finished."

The board decides the vast majority of the appeals it hears in favor of the county.

Mann says the rate at which property owners prevailed in their appeals was about steady with last year's rate, although it had been on the rise before then.

Property owners in Washington state have to meet the high standard of providing clear, cogent, and convincing evidence of an appraisal error to prevail in an appeal, he says.

Mann, a broker at John L. Scott-Citywide Spokane, also is on the legislative committee of the Washington Realtors trade group. He says he's tracking proposed state legislation that would lower property owners' standard to a preponderance of evidence.

"I have concerns if they do lower the standard, we're going to see more deals" that would reduce tax revenue, he says of the appeals process.

Mann says staff morale and work product at the Assessor's Office have improved under Horton.

"Vicki's done an incredible job turning the office around," he says.

Horton says the office has improved efficiencies without adding staff. In fact, the Assessor's Office has managed to maintain its staffing level in the face of budget cuts throughout the county government.

"We were able to take our cuts out of maintenance and operations and overtime budgets without losing people," she says. "Supervisors and work groups have created spreadsheets, reports, and ways of doing appraisals that have speeded things up."

The Assessor's Office has 42 employees, including 21 property appraisers.

Horton says she's had to shelve her earlier announced plans to add appraisers.

"There's been no staff increase," she says. "That's out the window."

An increase in the value of new construction is one indicator that the county's overall assessed value could be poised to head upward for the next tax year.

New construction added onto the rolls for the 2013 tax year was valued at $322 million, up from $283 million a year earlier, marking the first increase in new construction value since the 2008 tax year, when new construction value peaked at a lofty $1.1 billion.

"It looks like we're on track this year for an increase in building permits," Horton adds.

For tax purposes, construction permit valuations often lag values of building permits by a year.

"The assessment date for new construction is July 31," Horton says. "If it's not at least 40 percent complete—with roofs, windows, and doors, we don't put it on the tax rolls."

Trends in overall assessments also tend to lag the real estate sales market, she says.

For instance the median value of single-family homes in Spokane County is $139,700, while the median sales price of single family homes sold in Spokane County through the Spokane Association of Realtors Multiple Listing Service in 2012 was $160,000, up 3.7 percent compared with the 2011 median sales price.

Latest News

Related Articles