Home » Foreclosure actions dip, approach prerecession norms

Foreclosure actions dip, approach prerecession norms

Trend tied to job growth, health of housing market

January 14, 2016

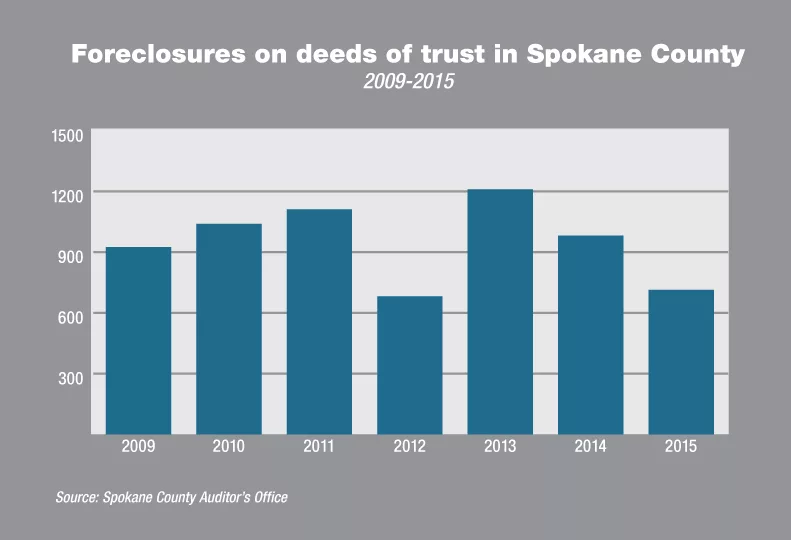

Foreclosure actions completed in Spokane County in 2015 dropped by 27 percent compared with the number of foreclosures in 2014, finally falling out of the historically high range, says Phil Kuharski, a longtime Spokane economic data analyst.

The Spokane County Auditor’s Office recorded 714 foreclosures on deeds of trust last year, down from 982 a year earlier.

A deed of trust is a pledge of real property commonly used to secure a mortgage.

Kuharski describes 2015 as a significant turning point regarding foreclosures in the Spokane market, bringing foreclosure numbers closer to normal.

“Normal for this market now is more in the 600 range for annual foreclosures for Spokane County,” he says. “Over 1,000 is stressful.”

Kuharski doubts, though, that numbers will dip to the prerecession ranges of below 400 foreclosures in the near future.

“We’ve still got a lot of leftovers from the 2008 fiasco,” he says. “There are still a few people underwater, but an awful lot have transformed out of a foreclosure situation to a resolution situation.”

The 2015 foreclosure total marks the second year of improvement in Spokane County following a spike in foreclosure actions in 2013 that brought a record total of 1,211 foreclosures.

Kuharski says, “The tie-in between the quality of jobs and the quality of the housing market is closely correlated with foreclosure numbers.”

Doug Tweedy, Spokane-based regional economist for the Washington state Employment Security Department, says the unemployment rate is falling, and a good portion of new jobs are paying above-average wages.

The Spokane-area unemployment rate was 5.5 percent in November, down from 7 percent a year earlier, he says.

Growing job sectors that pay above-average wages include health services; advanced manufacturing; education; and the professional, scientific, and technical sector, Tweedy says.

The average wage for the professional, scientific, and technical sector, at $56,400, is nearly $14,000 higher than the overall average annual wage of $42,650 in the Spokane area, he says.

The professional, technical, and scientific sector includes legal, accounting, and research-and-development professionals, he says, adding, “It’s small in numbers, but highest in growth percentage.”

Tweedy adds that Spokane is becoming a hub for transportation and warehousing because of the highway system and its proximity to the Spokane International Airport.

The average wage for a warehouse worker is more than $2,200 higher than the overall average wage here, he says.

Rob Higgins, executive vice president of the Spokane Association of Realtors, says multiple real estate trends are improving along with the decline in foreclosures.

The total number of homes sold through the association’s Multiple Listing Service in 2015 was 6,863, up nearly 18 percent compared with 5,829 homes sold in 2014.

About 13 percent of total sales were distressed properties in 2015, an improvement from a year earlier, when nearly 17 percent of sales through the Spokane MLS involved distressed properties, Higgins says.

Distressed properties include foreclosed, bank-owned, and short-sale properties that usually sell at below market value.

Meantime, the median sales price for homes sold through the Spokane MLS in 2015 was $180,000, up from $168,000 a year earlier.

Rising home values likely means more people are building up equity, which helps insulate them from foreclosure situations, Higgins says.

In Kootenai County, foreclosure actions have dropped consistently over a longer period of time, although they’re still above prerecession levels, according to data compiled for the fall 2015 Real Estate Report, a semiannual publication of the Spokane-Kootenai Real Estate Research Committee.

For the first nine months of 2015, 457 foreclosure actions were filed in Kootenai County, down from 633 actions filed in the year-earlier period.

Kootenai County’s foreclosure numbers have fallen annually since 2010 when foreclosure actions topped 2,900 at year-end.

Kootenai County’s foreclosure activities are reported differently and aren’t directly comparable to Spokane County’s foreclosures, because not all of the actions reported in Kootenai County result in foreclosures on deeds of trust.

Spokane-area foreclosure rates are slightly higher than statewide foreclosure rates but on par with national foreclosure rates, according to CoreLogic, a California- based real estate data service.

CoreLogic recently reported that the foreclosure rate in the Spokane-Spokane Valley metropolitan statistical area was 1.2 percent in October, trending downward from 1.4 percent a year earlier.

Latest News Real Estate & Construction Banking & Finance

Related Articles