INW banks report varied Q3 earnings

Net income projected to decline if Federal Reserve lowers interest rates

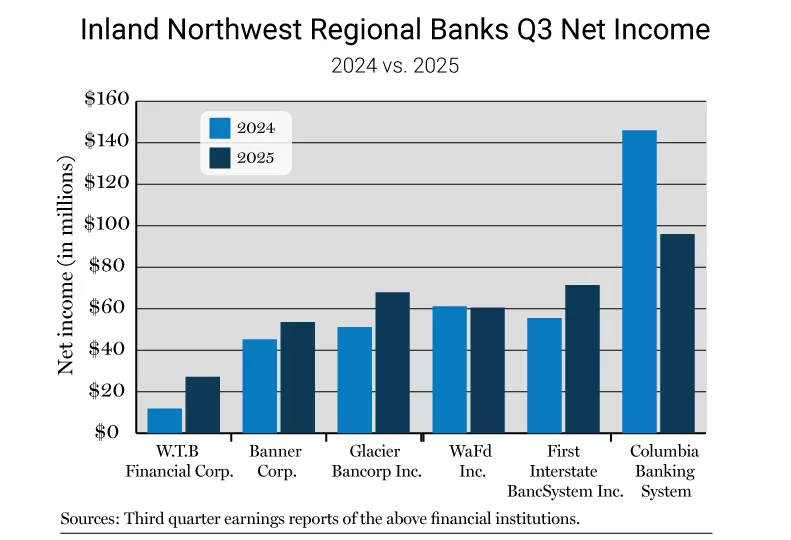

Most banks with an Inland Northwest presence showed an increase in third-quarter net income this year as compared to Q3 2024.

Third-quarter earnings reports released by some banks with a Spokane presence mostly show upward trends in net income due partially to raised federal interest rates and steady demand for commercial and industrial loans in the Inland Northwest.

W.T.B. Financial Corp., the Spokane-based parent company of Washington Trust Bank, has reported third-quarter net income of $27.2 million, or $11.09 per diluted share, up from $11.9 million, or $4.75 a share in the year-earlier quarter.

A company letter to shareholders regarding Q3 earnings ascribes the increase in income to the total net release of $7.3 million for credit losses and redeployed cash flows from their investment securities portfolio into new loan growth, as well as an increased demand for loans from commercial and industrial customers.

“Loan demand has remained solid, even with all the noise from politics and everything else,” says Washington Trust Bank Chief Economist Steve Scranton. “Talking to our commercial team, they said that the loan demand is solid, but maybe not in all areas. Commercial real estate is still a source of weakness, but your basic commercial and industrial loan have steady demand.”

Washington Trust Bank has 19 branches in the Spokane-Coeur d'Alene area, according to the Journal's April 10 Banks list.

First Interstate BancSystem Inc., the Billings, Montana-based parent company of First Interstate Bank, has reported third-quarter net income of $71.4 million, or $0.69 per diluted share, compared to $55.5 million, or $0.54 per share, in the year-earlier quarter.

The bank has 15 branches in the Spokane-Coeur d'Alene area.

Tacoma, Washington-based Columbia Banking System Inc. — the parent company of the formerly branded Umpqua Bank, now operating as Columbia Bank — has reported third-quarter net income of $96 million, or $0.40 per diluted share, a decline from $146 million, or $0.70 per share in the year-earlier quarter.

The company merged with Umpqua Holdings Corp., the parent company of Umpqua Bank, in March of 2023. Umpqua Bank rebranded to Columbia Bank on Sept. 1, 2025. Columbia Banking System's net income has been impacted by its acquisition of Pacific Premier Bancorp Inc., the parent company of Pacific Premier Bank, according to a press release from the financial institution

Columbia Bank has 12 branches in the Spokane-Coeur d'Alene area.

Walla Walla-based Banner Corp., the parent company of Banner Bank, has reported third-quarter net income of $53.5 million, or $1.54 per diluted share, an increase from $45.2 million, or $1.30 per share in the year-earlier quarter.

Banner Bank has 9 branches in the Spokane-Coeur d'Alene area.

Kalispell, Montana-based Glacier Bancorp Inc., the parent company of both Coeur d’Alene-based Mountain West Bank and Spokane-based Wheatland Bank, has reported third-quarter net income of $67.9 million, or $0.57 per diluted share, compared with net income of $51.1 million, or $0.45 per share in the year-earlier quarter.

Mountain West Bank operates five branches in the Spokane-Coeur d'Alene area. Wheatland Bank has two branches in the Spokane-Coeur d'Alene area.

Seattle-based WaFd Inc., parent company of WaFd Bank, has reported net income of $60.6 million, or $0.72 per share, slightly down from $61.1 million, or $0.71 per share in the year-earlier quarter. The company’s fiscal year ended Sept. 30, and this earnings report is for WaFd’s fourth quarter.

WaFd Bank has two branches in the Spokane-Coeur d'Alene area.

Coeur d’Alene Bancorp, the parent company of bankcda, has reported third-quarter net income of $402,111, or $0.21 per share, up nearly double from $253,324, or $0.13 per share, in the year-earlier quarter.

The organization has two branches in the Spokane-Coeur d'Alene area.

Charlotte, North Carolina-based Bank of America has reported third-quarter net income of $8.5 billion, or $1.06 per diluted share, compared to $6.9 billion, or $0.81 per share in the year-earlier quarter.

Bank of America operates seven branches in the Spokane-Coeur d'Alene area.

San Francisco-based Wells Fargo & Co. has reported third-quarter net income of $5.6 billion, or $1.66 per diluted share, up slightly from $5.1 billion, or 1.42 per share in the year-earlier quarter.

The organization has 10 branches in the Spokane-Coeur d'Alene area.

U.S. Bancorp, the Minneapolis-based parent company of U.S. Bank, has reported third-quarter net income of $2 billion, or $1.22 per diluted share, up from $1.7 billion, or $1.03 per share in the year-earlier quarter.

Wells Fargo operates 15 branches in the Spokane-Coeur d'Alene area.

“The bottom line is that the customer drives loan demand, not the banks,” Scranton says. “The banks may be calling on various businesses to see if they're looking for a loan, but I think under the current condition, there's enough steady demand for loans from the businesses coming to the financial institution looking for financing that you don't see too many finance institutions that have to go out knocking on doors.”

Looking forward to 2026, banks will likely see their earnings remain steady, Scranton says, adding that the market may see earnings fall due to lowered federal interest rates.

“I would expect to see, for most of the banks, that the earnings are stable. They will see their earnings probably dropping off a little bit as the Federal Reserve lowers interest rates because, especially for the commercial industrial loans, most of those are short term loans financing (a business’s) operations,” he says. “So, as the Federal Reserve cuts their short-term rate, the prime lending rate goes down too.”