Economic Forecast

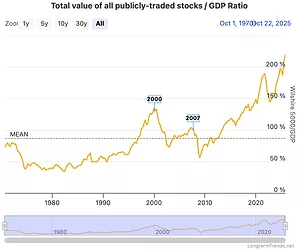

Markets without a map: When AI euphoria meets a data blackout

We're, in essence, experiencing information scarcity and what some perceive as speculative excess

Read More

Foundation remains solid, but expect growth to slow in coming year

Inflation, trade uncertainty, and volatility pose threats, but looser monetary policy, tax stimulus, and stable labor will help

Read More

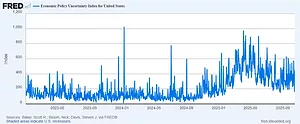

Uncertainty remains the watchword, and likely will continue in 2026

Overwhelming feedback from employers is that decisions on hiring or investments as slowed or halted.

Of disruption, disinterment, and relearning

Both Idaho and Washington cooled in 2025 and are likely to remain slow in the coming year.

Economic uncertainty and a tightening labor market make planning difficult

Spokane labor market has seen only tiny job gains, while civilian labor force here continues to decline

Read More

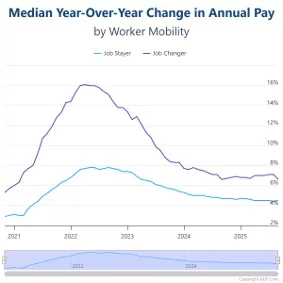

A slowing labor market reflects a slowing economy

Spokane County should mirror state's expected tepid growth in payroll employment in 2026

Read More

More INW startups, investing expected in 2025

New companies continue to emerge despite recent lull in funding

Read More

Health care leaders optimistic despite struggles

Providence's operating margins in Inland Northwest improving heading into 2025

Read More

_web.webp?t=1769673727)

_web.webp?t=1769673728)

_web.webp?t=1769673735)